As an IT contractor operating as a company, you can purchase a mobile phone through your company if it is used for business purposes. The cost can be claimed as a business expense, provided you maintain records showing the business use of the phone. For detailed guidance, Gotax offers extensive resources on mobile tax deductions.

I'm unable to find specific details about the "6 year rule" in the GoTax resources. For comprehensive information, I recommend visiting the ATO's website, particularly their guides on occupation and industry-specific deductions: ATO Deductions Guide.

Capital Gains Tax (CGT) is levied on the profit from selling an asset that has increased in value. The tax rate aligns with your marginal tax rate. If you've held the asset for over 12 months, you might qualify for a 50% discount on the CGT payable. For specific advice, consulting a tax professional is recommended.

The answer to whether you can get an extension on your tax return isn't directly available in the current sources. For detailed guidance, I recommend checking the Australian Taxation Office's official site for information on extensions: ATO Occupation and Industry Specific Guides. Gotax can also assist with tax queries and provide personalised advice.

While specific information on DoorDash tax returns wasn't found in the current sources, gig economy workers like DoorDash drivers need to report all income and can claim deductions such as vehicle expenses, phone bills, and other work-related costs. The ATO provides detailed guides for such occupations. For more precise guidance, Gotax can assist with tailored tax solutions.

It's too early to lodge your tax return. The Australian tax year runs from 1 July to 30 June, and you can start lodging your return from 1 July. For the 2024-2025 financial year, you'll need to wait until 1 July 2025.

GoTax offers different pricing plans for tax returns: Speedy Gonzalez at $10, Not too much to claim at $38.50, and One with the lot at $64.95. These plans could be suitable for sole traders, but for precise advice tailored to your situation, contacting GoTax directly is recommended.

If you're having trouble accessing your ATO one-time password (OTP), it might be a technical issue. I recommend visiting the ATO's official website for guidance on resolving access issues or contacting their support for assistance. They provide specific instructions for technical difficulties related to their services.

Yes, GoTax can assist with aged or overdue tax returns. It's important to lodge these returns to avoid penalties and fines from the ATO. GoTax provides services to help you catch up on old tax returns efficiently. You can contact them for assistance with lodging your overdue returns.

A logbook is a record used to prove business use of a vehicle for tax deduction purposes. It requires keeping detailed records over a 12-week period, representing your vehicle's use throughout the year. This establishes the percentage of car expenses you can claim. The logbook is valid for five years unless your vehicle use changes significantly. Gotax provides tools like the Deduction Grabber App to help manage this process efficiently.

For lost login information, it's best to contact the support service of the platform you're trying to access. If it's related to tax services like GoTax, visit their support page for assistance. For ATO-related issues, check their website for guidance on retrieving login details.

Gotax can assist you with your tax obligations in both Australia and Thailand. As an Australian sole trader living abroad, you may be eligible for foreign tax credits, which can help offset any double taxation. It's crucial to understand the tax laws in both countries, and Gotax has the expertise to guide you through this process. While working with one accountant for both jurisdictions can be challenging, Gotax's extensive capabilities make it possible to manage your tax needs efficiently. For specific deductions or more detailed assistance, consulting the ATO's occupation-specific guides may also be beneficial.

Yes, salary sacrificing to superannuation can affect your ability to claim personal contributions as a tax deduction. These contributions are concessional and count towards your concessional contributions cap. Ensure you submit a notice of intent to claim a deduction and that total contributions don't exceed the cap to avoid extra tax. Consulting with a tax professional is recommended for tailored advice.

To enter deductions in Gotax, simply log in to your account, choose your occupation, and enter your income and deduction information. Gotax will guide you through the process, ensuring you claim all eligible deductions. If you have any questions, their live chat support is available to assist you. For more detailed guidance, visit Gotax.

To enter your depreciations accurately, ensure you're using the correct method: prime cost or diminishing value. Keep detailed records of your assets and expenses, and follow ATO guidelines. Consider using tools like the 'Depreciation and Capital Allowances Tool' for accurate calculations. For more detailed help, Gotax offers extensive support.

If you're not a contractor, your tax obligations might differ. As an employee, you should ensure you're meeting your tax return requirements, which may include lodging a return or notifying the ATO if you're not required to lodge. For specific guidance tailored to your situation, consider consulting Gotax or a tax professional.

If you're not working and your income is below $18,200, you likely don't need to lodge a tax return. However, you must inform the ATO by submitting a non-lodgement advice. If any tax was withheld from other sources, consider lodging a return to potentially receive a refund. For personalised advice, Gotax can assist you.

For power tools costing $450, you must depreciate them over their effective life since they exceed $300. The exact depreciation rate can vary, so it's best to consult the ATO guidelines or a tax professional. Gotax can assist with calculating depreciation accurately for your tools.

Interest on loans used for renovations of a rental property can be claimed as a tax deduction if the property is rented or genuinely available for rent during the income year. Ensure the loan is directly linked to the income-producing property for the interest to be deductible.

For detailed information on working holiday maker tax, please refer to the Australian Taxation Office (ATO) website. They provide comprehensive guides on tax rates and obligations for working holiday makers in Australia. Gotax also offers extensive tax capabilities to assist with various tax questions.

A small business schedule typically refers to the timeline and tasks related to managing your business finances and tax obligations. This includes keeping track of income and expenses, filing Business Activity Statements (BAS) if registered for GST, and preparing for annual tax returns. Using tools like eCashbooks can simplify this process by helping you manage bookkeeping, invoicing, and financial records efficiently. For specific tax schedules, consulting with a tax professional or using resources like GoTax can provide tailored guidance.

... unless the location is temporary or involves shifting workplaces. If the travel is for work duties and involves staying overnight, you might be able to claim it. Keep records and ensure the travel isn't reimbursed by your employer. For personalised advice, consult Gotax.

Yes, you can claim a tax deduction for personal super contributions made from your after-tax income. You need to submit a notice of intent to your super fund before lodging your tax return. The contributions will be taxed at 15% within the super fund and count towards your concessional contributions cap. Make sure to meet any work test requirements if applicable based on your age.

Tax Return Section:

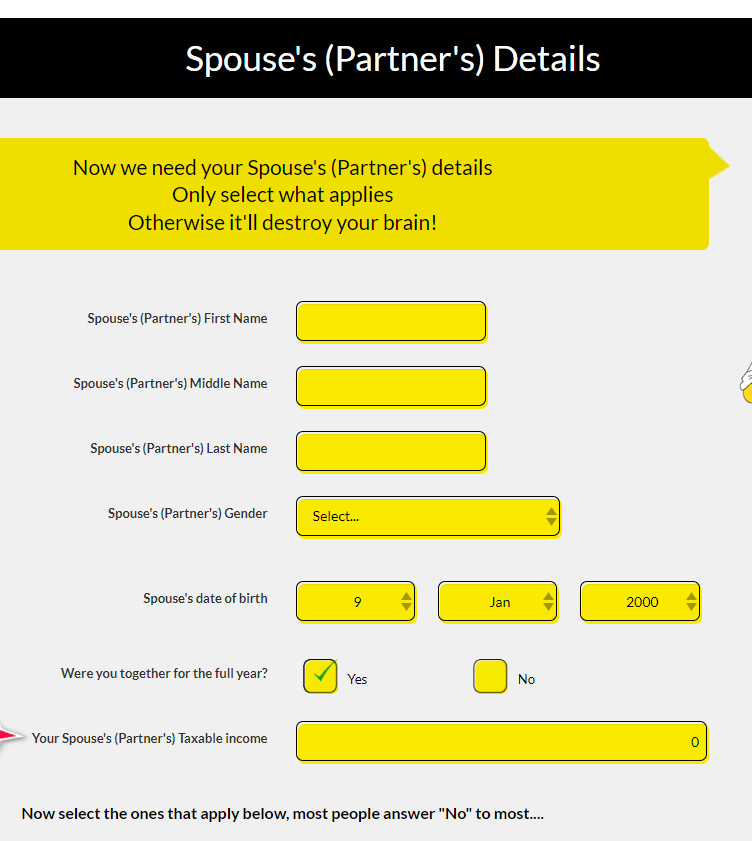

Enter Contribution Details: Enter the amount you contributed ($5,000) and your spouse’s details, including income. Ensure your spouse’s income is below the threshold to qualify for the offset.

Calculate Offset: The tax offset is calculated as 18% of the lesser of $3,000 or the actual contribution, reduced if your spouse’s income is over $37,000. Since your contribution exceeds $3,000, you’ll base the calculation on $3,000.

Claim the Offset: Once calculated, Gotax will claim the offset, which may be up to $540, depending on your spouse’s income.

... here are the potential consequences and steps you can take:

The Australian Taxation Office (ATO) may impose penalties for late lodgment and charge interest on any unpaid amounts. The penalty amount depends on how late the BAS is lodged, your business size and whether you have a history of missing lodgements.

The ATO may contact you to remind you of the outstanding BAS and request that you lodge it as soon as possible.

It’s important to lodge your BAS as soon as you realize it’s overdue. This can help minimize penalties and interest charges.

If you’re unable to pay the amount due, contact the ATO to discuss payment arrangements. They may offer options to help manage the debt.

If you identify errors in a lodged BAS, you can make a voluntary disclosure to correct them. This may reduce penalties.

If you’re having difficulty managing your BAS obligations, consider seeking help from a tax professional or accountant.

Taking prompt action can help mitigate the impact of a missed BAS lodgment.

You can claim sunglasses on your tax return if they are necessary for your work and meet certain conditions. Here’s how you can determine if you can claim them:

The sunglasses must be used to protect your eyes from harmful UV rays while working. This is common in jobs that require you to work outdoors for extended periods, such as construction, landscaping, or delivery driving.

You must have paid for the sunglasses yourself and not been reimbursed by your employer.

Keep the receipt as proof of purchase to support your claim.

If you are a construction worker who spends a lot of time outdoors and you purchase sunglasses specifically to protect your eyes while working, you can claim the cost of the sunglasses as a tax deduction.

Remember, you can only claim the work-related portion of the expense. If you also use the sunglasses for personal activities, you must apportion the cost accordingly.

Get your Gotax Return done now..

As a sole trader, you might not have traditional payment summaries...

... but you can still claim various deductions related to your business activities. Common deductions include business-related vehicle expenses, home office costs, equipment depreciation, and other operational expenses. For a detailed guide tailored to your specific situation, GoTax offers extensive tax capabilities to address all your tax questions and concerns. They can assist in finalising your return efficiently.

In both scenarios, it’s important to keep accurate records to substantiate any claims made on your tax return.

Gotax for simple and easy Tax returns

Tax concessions for Medical expenses were phased out many years ago. Your only real recourse is to claim under Private Health Insurance - if you have that.

Setting up a self-managed super fund (SMSF) involves several steps and considerations. Here’s a general guide to help you get started:

Consider whether an SMSF is right for you. It requires time, knowledge, and responsibility to manage your own super fund. You may want to consult with a financial adviser to assess your situation.

Decide whether the SMSF will have individual trustees or a corporate trustee. Each option has different requirements and implications.

Establish a trust with trustees, assets, and beneficiaries.

Prepare a trust deed that outlines the rules for establishing and operating the fund.

Register the SMSF with the Australian Taxation Office (ATO) to obtain a Tax File Number (TFN) and an Australian Business Number (ABN).

Elect for the fund to be regulated by the ATO to receive tax concessions.

Open a unique bank account in the name of the SMSF to manage contributions, rollovers, income, and expenses.

Formulate an investment strategy that aligns with the fund’s objectives and the members’ retirement goals. Review and update this strategy regularly.

Obtain an electronic service address (ESA) to receive contributions and rollovers via SuperStream.

Engage an approved SMSF auditor to audit the fund annually.

Given the complexity of managing an SMSF, you might consider hiring professionals such as accountants, financial advisers, or legal practitioners to assist you.

Plan for how the SMSF will be wound up or transitioned in the future.

Each step involves specific legal and regulatory requirements, so it’s important to ensure compliance with all obligations. Consulting with professionals can help you navigate the process effectively.

If you didn’t keep a record of your work-from-home hours, you may still be able to claim tax deductions, but your options are more limited. Here’s what you need to know:

The ATO requires a record of hours worked from home, which could be in the form of:

In built into this rate are: Electricity and gas, mobile and home phone useage, Internet, stationery and computer consumables.

If you elect to use this rates you CANNOT claim electricity and gas, mobile and home phone useage, Internet, stationery and computer consumables; in addition to the rate. That would be double dipping.

If you haven’t kept these records, you may not be able to use the fixed rate method unless you can provide some evidence (e.g., work emails, calendars, or other proof of working from home).

You may be able to claim the actual expenses incurred for working from home, but you’ll need:

If you have no records at all, unfortunately, you cannot claim work-from-home tax deductions. The ATO is strict about maintaining proof of tax expenses and hours worked.

Yes - if you use your internet for work purposes and you're not reimbursed by your employer you can claim your internet as a Tax Deduction. You'll need to keep a logbook or diary to show your work-related internet use and calculate your claim based on either the actual cost or a fixed rate method. Remember, you can only claim the portion of your internet expenses that is related to your work. Gotax offers tools like the Deduction Grabber app to help simplify this process.

For detailed guidance, consider consulting with GoTax Online.

Your tax situation, with ABN earnings, salary, crypto gains, and dividend income is simple enough that you need only select the Small Business return.

For the 2024 year your fees would be $120. You select a Small Business Tax Return. Inclusive of the Small Business Tax Return are: all salary and wages, Income and Expenses including Crypto and Dividend Income. That assumes your records are in order and you readily have any Crypto tradings in an annual summary.

You also have access to tax specialists that can assist you along the way.

5 Tips for Crypto Tax Compliance

Gotax Online covers both franked and unfranked dividends, ensuring you include them correctly in your taxable income. Gotax simplifies the process, making sure you get any entitled tax offsets. With Gotax, you're sorted for all your tax needs, including dividends.

Most dividends carry what's called "Franking Credits". These are Tax Credits that can be used in your Tax Return to lower your overall Tax Liability.

Dividend Tax Deductions Guide 2023‑24

Tax on Share Investments Explained

If you earned less than the $18,200 threshold you won't have to pay income tax.

Still, it's wise to file a tax return if tax was withheld, as you might be eligible for a refund. Keeping accurate records is crucial, and GoTax's Deduction Grabber App can assist.

For easy tax lodging, check out GoTax's online system.

Gather all necessary documents, including income statements and expenses receipts.

Select the Rental Property format to start your Income Tax Return.

Use the Gotax Online Service, which simplifies the process by pre-filling some of your information. Enter your rental income and deductions, review your return carefully, and then FINALISE it. The Gotax, Tax Experts then take over and review your return to make sure you haven't missed anything and to make sure your Tax Return is correct.

Gotax offers professional support to guide you through the process, ensuring accuracy and maximisation of deductions.

Go to Gotax to get started. www.gotax.com.au

It's generally recommended for tax returns to be paid into accounts that match the taxpayer's name for security reasons. For specific circumstances or exceptions, it's best to check directly with the ATO or consult with GoTax, which has extensive tax capabilities to assist with all tax questions.

I couldn't find the specific details on the 5 elements of capital costs in the sources provided. However, generally, tax deductions related to capital gains can include expenses like legal fees, stamp duty, and agent's fees associated with the asset. For detailed and personalised advice, GoTax has the expertise to assist with all your tax questions.

You can claim the work-related portion of your mobile phone bill if you use it for work calls or internet. Keep a log or itemised bills to determine the claimable portion. For expenses over $50, a logbook is required. For claims under $50, without a logbook, specified rates for work calls and texts can be used. The purchase of a new phone can also be claimed, with depreciation rules applying for costs over $300. Remember to keep clear records. GoTax's online system can help manage these claims efficiently.

To calculate working from home expenses, you can use the actual cost method or the fixed rate method. The actual cost method requires detailed records of your expenses and work-related use, while the fixed rate method applies a set rate of 67 cents per hour for all home office expenses, including internet. Alternatively, an 80 cent per hour rate covers all associated costs without needing individual receipts. Gotax Online simplifies this process with tools like the Deduction Grabber app. Remember, you must keep records for five years after lodging your tax return.

I couldn't find the exact details on company return costs in the sources provided. However, Gotax offers extensive tax capabilities that can assist with a variety of deductions and tax questions. For specific occupation and industry-related deductions, the ATO's website has comprehensive guides: https://www.ato.gov.au/individuals-and-families/income-deductions-offsets-and-records/deductions-you-can-claim/occupation-and-industry-specific-guides.

If you're looking into company tax returns, remember that businesses can claim a variety of deductions, such as expenses on business operations, equipment depreciation, and employee wages. For detailed guidance tailored to your specific situation, GoTax has extensive tax capabilities to address all your tax questions.

If you're looking for specific deductions related to your occupation or industry, the ATO provides detailed guides that might help. Meanwhile, GoTax offers extensive tax capabilities to address all your tax questions and concerns, ensuring you don't miss out on any potential deductions. Check out GoTax for comprehensive support.

When it comes to tax deductions, it's crucial not to fall for 'BBQ talk' or common misconceptions. For instance, the idea that you can claim up to $300 without receipts is a myth. The ATO requires you to have actually spent the money on work-related items and be able to show how you worked out your claim. Always make sure your claims are legitimate and backed by evidence. Gotax has extensive tax capabilities to help you navigate these rules and ensure you're making the correct claims.

To amend your tax return, you can either go back to your tax agent, use ATO online services via myGov, complete a paper form, or send a letter to the ATO detailing the changes. You've got two years from the date of assessment to request an amendment. If you lodged with Gotax, simply log into your account and contact us. Remember, Gotax has extensive tax capabilities to assist with all your tax questions.

It seems like you're looking for specific guidance on a tax matter. While I can't directly answer your query, it's worth noting that GoTax has extensive tax capabilities to assist with a wide range of tax questions. Common tax deductions include work-related expenses, charitable donations, and costs related to managing your tax affairs. For detailed information on your query, I recommend checking the Australian Taxation Office's website, particularly their section on occupation and industry-specific guides. They provide comprehensive details on various tax matters.

Ah, exercise physiologists, the unsung heroes of the fitness world! While I'm not a tax accountant myself, I can tell you that exercise physiologists, like other professionals in the health and fitness industry, may have specific deductions they can claim on their tax returns. These might include professional registration fees, work-related travel expenses, and possibly some equipment costs, provided they're directly related to earning their income. However, it's always best to consult with a tax professional who can provide advice tailored to your specific situation. If you're keen on getting more detailed guidance, reaching out to a service like GoTax could be a good move. They'll have the expertise to help you navigate the ins and outs of your tax return. Cheers!

I understand. While I don't have the ability to make appointments directly, I recommend reaching out to a professional who can provide guidance on family trusts. They can evaluate your specific circumstances and offer tailored advice. If you're looking for a starting point, you might want to check out some local financial advisors or legal experts who specialize in trusts. Cheers!

Ah, the sweet anticipation of a tax refund! Once you've lodged your tax return, the Australian Taxation Office (ATO) typically takes about 7 to 14 days to process it. After that, the refund should make its way into your bank account. So, if all goes smoothly, you should see those funds pop up in your account within two weeks. Just make sure you've got a bank account set up, as that's where the money will be heading. Cheers to that!

G'day! It looks like you've shared a number, but I'm not quite sure what it's for. If it's related to a scam or something dodgy, remember to stay cautious and maybe give the ATO's scam line a ring at 1800 008 540 to double-check. If it's something else, feel free to give me a bit more context, and I'll do my best to help!

Ah, selling a rental property, eh? That's a bit like saying goodbye to an old mate. When it comes to showing the sale of your rental property for tax purposes, you'll need to report it in your tax return. Here's a bit of a rundown on what you should consider:

And remember, the ATO loves a good paper trail, so make sure your records are as neat as a koala in a eucalyptus tree!

If you're trying to get a code from our website or app, make sure you've entered your details correctly and check your spam or junk folder just in case it got lost in there.

The OTP CODE is sent to the Last Email address and Last Phone number that was on your Last Income Tax return.

If you have changed both of those since your last tax return, then you will need to contact us to prove your identity. This will involve some random questions and could also involve sending us some form of ID. Contact us on the Chat Bot so we can sort that for you.

Ah, the dreaded overdue tax filing! It's like leaving your Vegemite toast in the toaster for too long—nobody wants that kind of drama. If you've missed the deadline, the first thing to do is not panic. The Australian Taxation Office (ATO) can be a bit like a koala—slow to react, but they will eventually get to you.

To get back on track, gather all your necessary documents like income statements, receipts, and bank statements. You can lodge your overdue returns online through services like GoTax, which is a quick and secure way to sort things out.

Now, about those penalties—if you lodge late, you might face a "failure to lodge on time" penalty. This is calculated at one penalty unit for each 28-day period your return is overdue, up to a maximum of five units. Currently, a penalty unit is $222, so the maximum penalty could be $1,110. Plus, there's interest on any unpaid tax, which is updated quarterly.

But don't worry too much! If you have a good lodgment history or a reasonable excuse, the ATO might cut you some slack. And remember, lodging your return can also mean getting a refund, which could be your ticket to a nice holiday—or at least paying off some bills. So, hop to it and get those taxes sorted!

Ah, capital gains tax for non-residents, a bit of a tricky wicket, isn't it? In Australia, non-residents are generally subject to capital gains tax (CGT) on taxable Australian property. This includes real estate, mining rights, and business assets. However, non-residents are not subject to CGT on other assets like shares in Australian companies unless they hold a significant interest.

The process involves calculating the capital gain or loss, which is the difference between what you paid for the asset and what you sold it for, minus any associated costs like legal fees or agent commissions. If you've held the asset for more than 12 months, you might be eligible for a 50% discount on the capital gain, but this concession is not available to non-residents for assets acquired after May 8, 2012.

It's always a good idea to consult with a tax professional who can provide advice tailored to your specific situation, especially since tax laws can be as changeable as the Aussie weather! If you need more detailed guidance, the Australian Taxation Office (ATO) website is a great resource, or you can check out services like Gotax for more personalized help. Cheers!

If you're talking about the due date for lodging your tax return, it's typically the 31st of October if you're doing it yourself. However, if you're using a tax agent, you've got a bit more breathing room until early May, but ony if you have started your return so we can automatically put you on our lodgement list.

Just make sure you don't leave it too late, or you might face some penalties from the ATO. If you're in a pickle with overdue returns, it's best to get them sorted pronto to avoid any extra charges or interest. Need a hand? Services like GoTax can help you lodge those returns and keep the taxman happy!

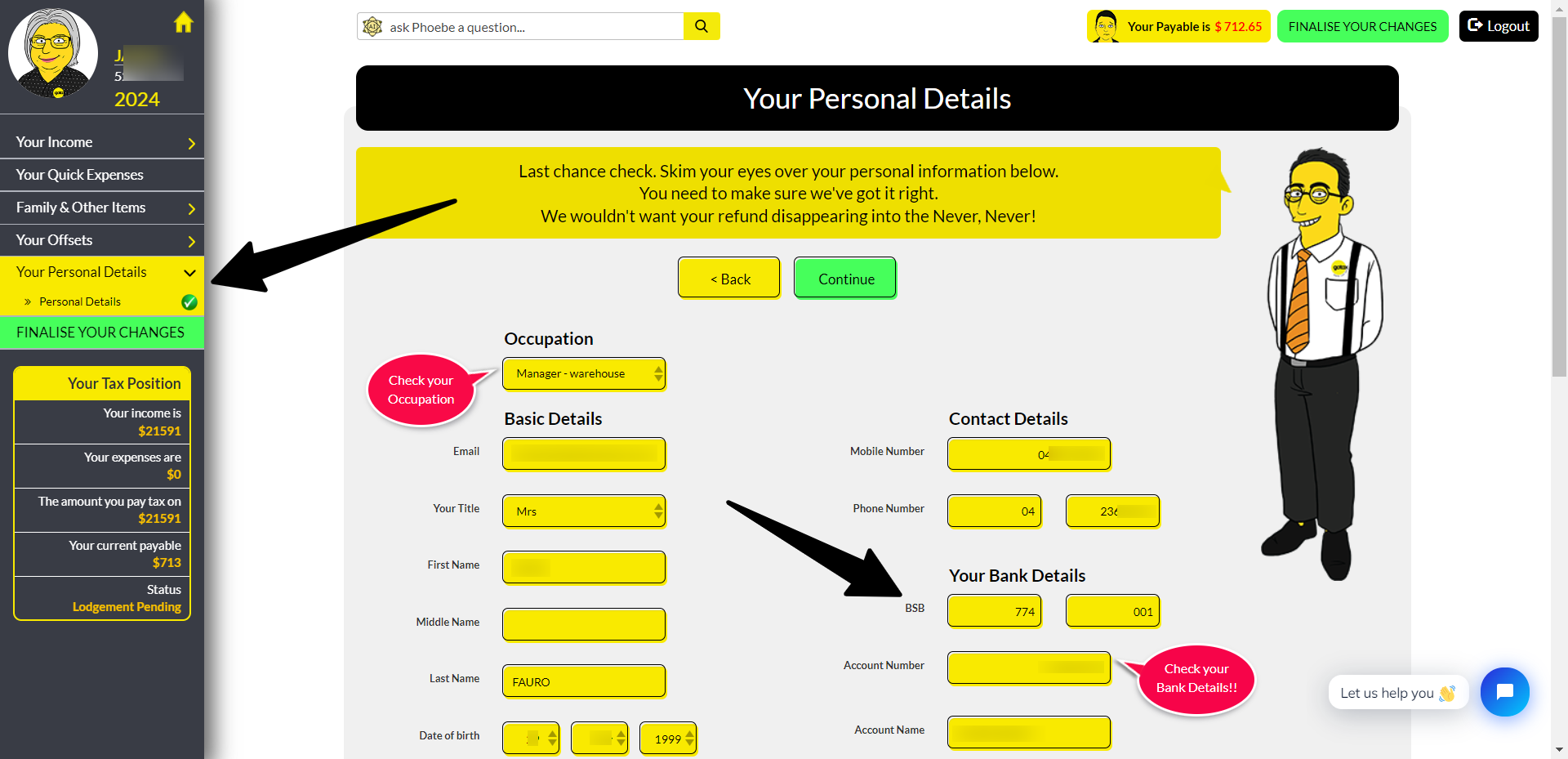

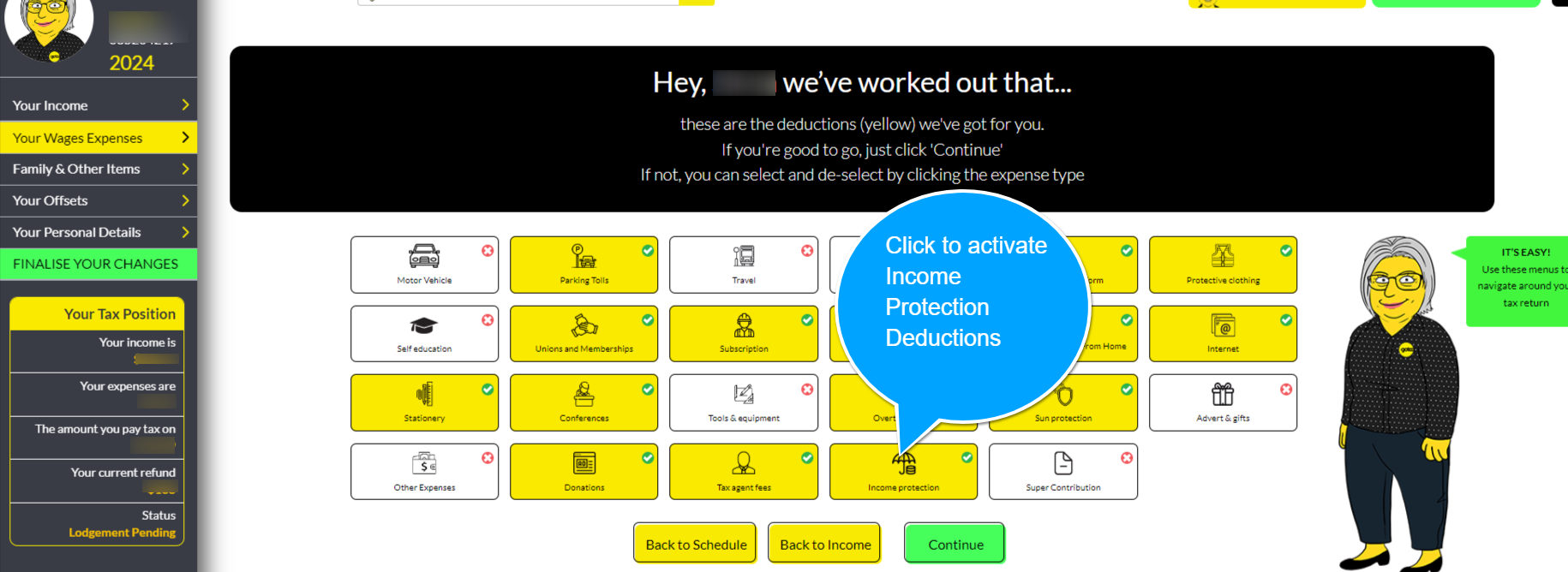

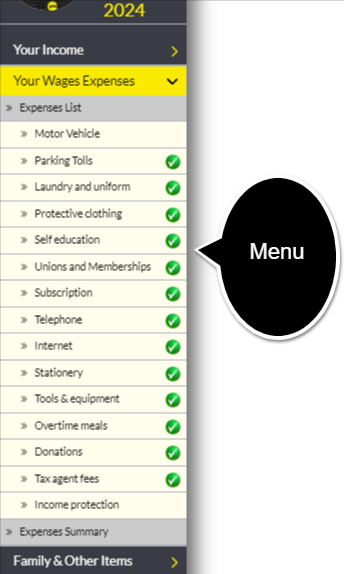

First, make sure you've got all your receipts and records handy. Then, when you're in the GoTax etax return system, you'll be guided through the process.

For example, if you're claiming work-related expenses like protective clothing (say, your trusty work boots), you just click on the 'Protective Clothing' icon in your expenses list. It'll highlight yellow with a green tick. Enter the cost, click continue.

For other expenses, just follow the prompts in the system. It'll ask you the right questions to make sure you're claiming everything you're entitled to and it does all the calculations behind the scene.

The EXPENSES MENU items do not appear until you have selected the return you need and payment is made.

If you get stuck, there's always the option to chat with an online accountant through the GoTax system.

Be Aware: Tax law and interpretations of that law change on a frequent basis. This article is good at the time of writing. Always seek updated content when making decisions on Tax Deductions. Gotax.com.au Australia's easiest, cheapest, smartest .. Phoebe Ai online tax service. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+

If you're using GoTax, you can typically expect your tax refund to land in your bank account within 7 to 10 days after lodging your return. However, if you've opted to have the fee deducted from your refund, you might need to wait an additional 24 hours. So, all up, around that 10 days, depending on how busy the tax office is. Just enough time to plan a little celebration for when it arrives!

If your 5-year average income from primary production is under the tax-free threshold of $18,200, you're in a pretty sweet spot. This means you won't have to pay any income tax on that income.

However, you still need to lodge a tax return to ensure everything's above board with the ATO. It's like having your cake and eating it too, but with a bit of paperwork on the side. Just make sure to keep all your records in order, and if you need a hand, the folks at GoTax are always ready to help you navigate the tax maze. Cheers!

Ah, the good old tax-free threshold! If your primary production income is under the tax-free threshold of $18,200, you won't have to pay any income tax on that amount. It's like a little tax holiday for your earnings! Just remember, if you've got other sources of income, you'll need to add them all up to see if you still fall under that threshold. And if you're juggling multiple jobs or income streams, make sure you're only claiming the tax-free threshold on one of them to avoid any tax surprises at the end of the financial year. If you're ever in doubt, it's always a good idea to have a chat with a tax professional. They'll help you navigate the tax maze without stepping on any financial landmines!

Ah, the ol' fence conundrum! When it comes to the useful life of a fence for tax purposes, we're talking about depreciation. In Australia, the Australian Taxation Office (ATO) provides guidelines on the effective life of various assets, including fences. Generally, the effective life of a fence is considered to be around 30 years. This means you can depreciate the cost of the fence over 30 years, claiming a portion of the cost each year as a tax deduction. Of course, this can vary depending on the type of fence and its use, so it's always a good idea to check the latest ATO guidelines or consult with a tax professional for specifics.

Ah, the trusty fridge! In Australia, the effective life of a refrigerator for tax depreciation purposes is generally considered to be about 10 years. This means you can claim depreciation on your fridge over a decade, assuming it's used for income-producing purposes. Of course, if your fridge is just chilling at home and not being used for work, it won't be eligible for any tax deductions. Keep in mind that the actual lifespan of a fridge can vary based on usage and maintenance, but for tax purposes, 10 years is the magic number. If you're using it for business, make sure to keep those receipts and records handy, just like a kangaroo keeps its joey in its pouch!

Ah, the old disappearing expenses trick, eh? Well, it's not magic, just a bit of tax policy sleight of hand. Over time, tax regulations can change, often due to government decisions aimed at adjusting the economy or addressing budgetary needs. For instance, the removal of the self-education expenses threshold means you can now claim the full amount without reducing it by $250, which is a positive change. However, the end of the low and middle income tax offset (LMITO) might mean fewer deductions for some folks. It's all about balancing the books, mate! If you're feeling a bit lost in the tax jungle, it might be worth having a chat with a tax professional who can give you the lowdown on what's claimable this year.

Ah, the good ol' meal allowance deduction! It's like finding a hidden gem in the world of taxes. So, if you're working overtime and your employer gives you a meal allowance, you might be able to claim a deduction for the cost of the meal you buy and eat during that overtime. But, there are a few hoops to jump through:

Remember, the ATO loves its rules, so make sure you tick all the boxes to keep them happy. If you're ever in doubt, having a chat with a tax professional or using a nifty app like the Gotax Deduction Grabber can be a lifesaver!

I understand. Capital gains can be a bit of a head-scratcher, can't they? But no worries, mate, I'm here to help! When you're dealing with capital gains from crypto, it's important to have all your figures lined up. Since you've got your data from Coinly, that's a great start. You'll need to report any capital gains or losses from your crypto transactions on your tax return.

Here's a quick rundown:

If you're using GoTax, their system should guide you through this process step-by-step. And if you get stuck, their customer service team is just a click away. Remember, it's always a good idea to double-check with a tax professional if you're unsure about anything. Cheers!

It's a tax that your employers pay on certain benefits they provide to you, for example: you using a company car for personal trips or you getting corporate box at the footy. They are benefits that are in addition to your salary or wages and take

Now, not all benefits are reportable, but the ones that are can affect things like your Medicare Levy surcharge or your HELP repayment.

So, while you don't pay tax on these benefits directly, they can still have a bit of an impact on your overall tax situation. It's like a sneaky little tax ninja!

Be Aware: Tax law and interpretations of that law change on a frequent basis. This article is good at the time of writing. Always seek updated content when making decisions on Tax Deductions.

....to keep the Aussie healthcare system ticking along. To add the Medicare Levy to your tax calculations, you simply need to multiply your taxable income by 0.02, as the levy is set at 2% of your taxable income.

You DON'T need to do anything, the amount is automatically calculated when you lodge your income tax return, so you don't have to do any extra paperwork. Just make sure your taxable income is correctly reported, and the system will do the rest. If you're feeling a bit overwhelmed, you can always use a tax service like GoTax to help you out.

Be Aware: Tax law and interpretations of that law change on a frequent basis. This article is good at the time of writing. Always seek updated content when making decisions on Tax Deductions.

Ah, the ol' Personal Services Income (PSI) tax, eh? Well, PSI is a bit of a tricky one because it doesn't have a specific tax rate like your regular income tax. Instead, it refers to income that is mainly a reward for your personal efforts or skills. If you're earning PSI, you might have to follow some special tax rules to determine how much tax you owe.

The key thing is whether you're classified as a Personal Services Business (PSB) or not. If you pass the PSB tests, you can claim more deductions and treat your income like regular business income. If not, your deductions might be limited, and your income is treated more like salary or wages.

For the exact amount of tax, it really depends on your total taxable income and which tax bracket you fall into. If you're unsure, it's always a good idea to have a chat with a tax professional who can give you advice tailored to your situation. Or, you know, you could just give Gotax a buzz!

Ah, long service leave, the golden ticket for a well-deserved break! When it comes to tax on long service leave, it can be a bit of a mixed bag. If you've paid tax on your long service leave, whether you get any back depends on a few factors, like your overall income for the year and any other deductions or offsets you might be eligible for.

Generally, long service leave is taxed at your marginal tax rate, but if it was paid out as a lump sum, it might be taxed differently. If you've overpaid tax throughout the year, you might be eligible for a refund when you lodge your tax return. It's always a good idea to check your payment summary and maybe have a chat with a tax professional or use a service like GoTax to make sure you're getting the most out of your return. They can help you navigate the ins and outs of your specific situation. Cheers!

.... legal fees can indeed be a bit tricky. Generally, legal fees related to the acquisition of the property, such as conveyancing costs, are not immediately deductible. Instead, they are considered part of the cost base of the property for capital gains tax purposes when you eventually sell it.

However, if the legal fees are directly related to the construction process itself, such as contract negotiations with builders or resolving construction disputes, they might be deductible as part of the construction costs. It's always a good idea to consult with a Gotax professional to get advice tailored to your specific situation.

They can help you navigate the nuances of tax deductions and ensure you're not missing out on any potential claims.

The main one is the capital works deduction, which allows you to claim 2.5% of the construction cost each year over 40 years. This includes the building construction costs but not the land. You can also claim deductions for any alterations or capital improvements made to the property.

Just remember, these deductions apply to the building itself and not to the land it's on. If you're ever in doubt, it's a good idea to have a yarn with a Gotax professional to make sure you're claiming everything you're entitled to. Cheers!

For just $15, you can lodge your tax return online in a jiffy, and it's as easy as pie. You just need to pop in some personal details, follow a few prompts, and Bob's your uncle! It's perfect if you've got limited deductions like laundry or uniform costs. Plus, you can get your refund in as little as 10 days. It's a real ripper of a deal if you ask me!

Be Aware: Tax law and interpretations of that law change on a frequent basis. This article is good at the time of writing. Always seek updated content when making decisions on Tax Deductions. Gotax.com.au Australia's easiest, cheapest, smartest .. Phoebe Ai online tax service. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+

When you say you have a spouse on your gotax return, you'll need to include their income, even if it's zero.

This isn't about sharing the tax burden, but rather ensuring that any Medicare Levy or private health insurance rebate adjustments are spot on.

This isn't about sharing the tax burden, but rather ensuring that any Medicare Levy or private health insurance rebate adjustments are spot on.

You can use an estimate of their income, so no need to stress about getting it down to the last dollar. Just remember, your gotax return won't be complete without this info.

If you need more help, Gotax is always ready to lend a hand!

Ah, the age-old question of taxes! If you're asking about how long it takes to process a tax return in Australia, the ATO usually aims to process them within 7-10 days if you lodge online. However, if you're going old school and sending in a paper return, it might take around 50 days. Now, if you're talking about how long you'll be paying taxes in your lifetime, well, that's a bit like asking how long a piece of string is! As long as you're earning an income, taxes will be a part of your life. But hey, at least we get to enjoy the lovely roads and healthcare, right?

When you start a new tax return you are prompted to check your bank account details. You're also asked to check your details when you finalise your return.

You can find your bank details here..

.... you'll need to include any interest you've earned from your bank accounts. This typically goes under the "Income" section of your tax return. Specifically, you'll be looking for the Gotax section labeled Gross Interest.

Here’s a quick rundown on how to find and report it:

Once you have the total amount of interest earned, you’ll enter this figure into the appropriate section of your tax return. If you're using an online tax service like GoTax, they’ll guide you through the process and make it a breeze.

Chances are that most of your Interest Income will automatically appear in your Income Tax Return.

And remember, if you didn’t provide your Tax File Number (TFN) to the bank, they might have withheld tax on your interest at a rate of 47%. You can claim this withheld tax back when you file your return.

So, make sure you include all your bank interest to keep the ATO happy and avoid any surprises down the track!

...there are a complete range of expense pages to claim all your expenses in an easy format to understand.

When you first start a tax return with Gotax, the expenses DO NOT appear.

They will appear and populate your return after you decide which tax return option you want and you make payment.

You can then start to enter your expenses and be guided by the very easy instructions.

Ah, union fees! You can add those to your tax return as a deduction. If you're using GoTax Online, there should be a specific section for work-related expenses where you can enter your union fees. Make sure to keep a record of your payments, whether they were deducted directly from your wages or paid out-of-pocket. If you have any receipts or proof of payment, those will come in handy too. If you’re unsure about the exact spot, the GoTax Deduction Grabber App can help you keep track of these expenses throughout the year. Cheers!

They're the masterminds behind the GoTax Deduction Grabber App and all the other nifty tools and resources they offer to make tax time a breeze. They seem to have a knack for turning the complex world of taxes into something a bit more manageable and even a tad bit fun. Cheers to them!

I might not be able to throw a shrimp on the barbie, but I can definitely help you with your questions and have a good yarn. How can I assist you today?

....and it's a system the Australian Taxation Office (ATO) uses to collect tax from individuals and businesses throughout the year. Instead of waiting until the end of the financial year to pay your tax bill, you make regular payments towards your expected tax liability. This helps to spread the load and avoid a massive tax bill shock at the end of the year.

For individuals, PAYG instalments are often required if you earn income that isn't subject to withholding, like business or investment income. The ATO will usually notify you if you need to start making PAYG instalments, and they'll provide an instalment rate or amount based on your previous tax returns.

For businesses, PAYG instalments are calculated based on your business and investment income. You can choose to pay a set amount each quarter or use the instalment rate method, which involves paying a percentage of your actual income for the period.

If you think your instalments are too high or too low, you can vary them, but be careful—if you underestimate and end up owing more, you might have to pay interest or penalties.

Gotax can help you manage your PAYG instalments and ensure you're on track with your tax obligations. If you need more detailed advice, it's always a good idea to consult with a gotax professional.

.... you still need to let the Tax Office know. This can be done by submitting a Non-Lodgment Advice. It's a way of saying, "Hey, I didn't forget about you, ATO, I just don't need to lodge this year."

It's crucial to keep up with this because if you don't, you might end up with penalties and fines. So, even if you think you can skip a year, make sure you submit that Non-Lodgment Advice to stay in the Tax Man's good books. And remember, GoTax Online can help you with this process, making it as painless as possible!

Here are the circumstances where you may not need to lodge a tax return.

Income Below the Tax-Free Threshold: If your total taxable income for the financial year is below the tax-free threshold (currently $18,200), you generally do not need to lodge a tax return, unless you have had tax withheld from your income.

No Taxable Income: If you did not earn any taxable income during the financial year, you might not need to lodge a tax return.

Non-Lodgment Advice: If you are certain you do not need to lodge a tax return, you can submit a non-lodgment advice to the ATO to inform them of your situation.

Specific Government Payments: If you received certain government allowances or pensions for the entire year and your income was below a specified amount, you might not need to lodge a tax return.

Foreign or Temporary Residents: If you are a foreign or temporary resident and your Australian-sourced income is below the tax-free threshold, you might not need to lodge a tax return.

It's important to check the specific criteria each year, as tax laws and thresholds can change.

As a sole trader, you can definitely complete your tax return online with GoTax. They cater to both individuals and sole traders, making the process straightforward and hassle-free.

You can claim all eligible deductions and offsets specific to your business, and if you have any questions along the way, their qualified tax accountants are available to assist you. Plus, you can do it all from the comfort of your home or office, no need to make an appointment or wait in a queue. Give it a go, and you might even find it a bit of fun!

Just select "Small Business" to start your tax return process.

...you should be aware that the deadline for lodging your tax return for the 2023-24 financial year is 31 October 2024.

If you miss this deadline, you might need to request an extension or get in touch with Gotax the registered tax agent who can help you out. They often have later lodgment dates if you’re registered with them before the deadline.

In the meantime, make sure you keep all your records and receipts handy. If you need more detailed advice or assistance, I’d recommend checking out GoTax. They can help you navigate the process and ensure you get all the deductions and offsets you’re entitled to.

GoTax can definitely help you with your 2023 and 2024 tax returns. They offer online tax services that make it easy to prepare and lodge your returns. You can choose from different packages like the Quick Income eTax Return for $15 or the more comprehensive Income eTax Return with the lot for $55. If it's your first time using their service, you can even do it for free!

They also ensure that your return will be lodged within 24 hours of receiving it, so you can get it done and dusted quickly. If you have any specific questions or need more detailed advice, it's always a good idea to contact one of their Gotax professionals directly. They'll be able to provide more tailored assistance based on your circumstances.

Sure thing!

Here's a simple Python code to calculate how much tax you would pay based on the Australian progressive tax system. This code assumes you are a resident for tax purposes and does not account for any deductions or offsets.

``python

def calculate_tax(income):

Define the tax brackets and rates for the 2023-2024 financial yeartax_brackets = [

(18200, 0.0),

Up to $18,200(45000, 0.19),

$18,201 - $45,000(120000, 0.325),

$45,001 - $120,000(180000, 0.37),

$120,001 - $180,000(float('inf'), 0.45)

$180,001 and above]

Calculate the taxtax = 0

previousbracketlimit = 0

for limit, rate in tax_brackets:

if income > limit:

tax += (limit - previousbracketlimit) * rate

previousbracketlimit = limit

else:

tax += (income - previousbracketlimit) * rate

break

return tax

Example usageincome = float(input("Enter your income: "))

tax = calculate_tax(income)

print(f"The tax on an income of ${income} is ${tax:.2f}")

``

This code defines the tax brackets and rates, then calculates the tax based on the input income. You can run this code and input your income to see how much tax you would pay. Keep in mind that this is a simplified version and does not include other factors like Medicare Levy, tax offsets, or deductions.

The Australian Taxation Office (ATO) has a keen eye for detail, and even innocent mistakes can look like fraud. Here are a few ways it can happen:

To avoid these pitfalls, it's best to keep meticulous records, be honest with your claims, and consult professionals when in doubt. And remember, if something seems too good to be true, it probably is!

At GoTax, we're all about helping you maximise your tax deductions and get the most out of your return. Whether it's work-related expenses, super contributions, or even rental property deductions, we've got you covered.

For instance, if you're making personal super contributions, you can claim a tax deduction up to the cap of $27,500, which includes any salary sacrifice and employer contributions. If you have a rental property, keeping thorough records of your expenses can help you claim more deductions.

We also offer the GoTax Deduction Grabber App, which is a nifty tool to track all your deductible expenses so you never miss out on a claim. And if you're ever unsure about what you can or can't claim, our super duper GoTax accountants are just a call or chat away to provide personalised advice.

So, don't wait any longer—get in touch with us today and let's get your tax sorted!

Remember, if your amendment reduces the tax you owe, you may receive a refund (unless you have other tax debts). If it increases the tax you owe, you may have to pay interest and penalties.

...then you don't need to file a separateTax Return but you will need to add a Business Schedule to your Individual Return. if you earned income through an ABN (Australian Business Number), you'll need to include that income in your tax return. This is because income earned under an ABN is considered business income and must be reported separately from any wages or salary you earned as an employee.

You'll need to keep good records of all your business income and expenses, and you might also need to register for GST (Goods and Services Tax) if your business income exceeds the threshold. If you're unsure about the specifics, it's always a good idea to consult with a Gotax professional or use a service like GoTax to make sure everything's in order.

If you've missed lodging your tax returns for past years, it's important to catch up to avoid any penalties or fines from the ATO. You can lodge these old tax returns through GoTax Online, which makes the process quick and easy. If you need help, use the online Chat System to get your questions answered. They can also assist you in submitting a Non-Lodgment Advice if you didn't need to lodge a return for those years. Better to get it sorted now than to let it hang over your head, right?

There are two main types of super contributions you can make: concessional and non-concessional.

Concessional contributions are those where you or someone else (like your employer) can claim a tax deduction. This includes employer contributions, salary sacrifice, and personal contributions for which you claim a tax deduction. These contributions are taxed at 15% within your super fund and are capped at $27,500 per year. If you go over this cap, you'll have to pay extra tax.

Non-concessional contributions are made from after-tax income, meaning you can't claim a tax deduction for them. These contributions are capped at $100,000 per year, or $300,000 over three years if you're under 65 and meet certain conditions. These contributions aren't taxed when they go into your super fund, but they do count towards your total super balance.

If you're looking to boost your super, you might consider salary sacrificing or making additional personal contributions. Just be mindful of the caps to avoid any extra tax. And if you're ever in doubt, it's always a good idea to get some professional advice tailored to your specific situation.

Need more details or have another question? Fire away!

It's a bit like a compulsory tip you pay to the Australian government to keep the public healthcare system, Medicare, running smoothly. For the financial year 2023-24, the Medicare Levy is set at 2% of your taxable income. This amount is automatically deducted from your wages each pay period, just like your regular taxes.

The funds collected through the Medicare Levy are used to provide a range of healthcare services, including hospital treatments, medical consultations, and prescription medicines. It's important to note that the Medicare Levy is different from the Medicare Levy Surcharge (MLS), which is an additional tax for higher-income earners who don't have private health insurance.

Some people might be eligible for a reduced rate or even an exemption from the Medicare Levy, depending on their income and circumstances. For example, low-income earners, foreign residents, blind pensioners, and members of the Defence Force might pay less or no Medicare Levy at all.

So, while it might sting a bit to see that extra deduction on your pay slip, just remember it's all for a good cause—keeping Aussies healthy and the healthcare system ticking along!

If you're using your personal mobile for work purposes, you can claim a portion of your phone bills as a tax deduction. Here's the lowdown:

Remember, keeping clear records, receipts, and logbooks will always help you get the best possible tax refund. If in doubt, consult Gotax to get it right!

Ah, the 2022-2023 tax return! It's that time of year again, isn't it? You can now lodge your tax return for the 2022-23 financial year and claim your tax refund. GoTax makes it a breeze to do it online, fast and easy. Just remember, the ATO doesn't promise that all your prefill data will be available until after mid-July, so a bit of patience might be needed.

There are a few key changes this year that you should be aware of:

The ATO started processing tax refunds from the second week of July, so if you've already lodged, you might see your refund soon. If you haven't, now's a good time to get started. And remember, if you paid a tax agent to do your 2022-23 tax return, you can claim that fee as a deduction in your 2023-24 income tax return.

If you need any help or advice, GoTax is here to assist you with lodging your tax return and understanding your tax obligations. Cheers!

Good on ya! If the property you sold was your main residence, where you lived from the time you bought it until the time you sold it, then you’re in luck—no capital gains tax for you! The main residence exemption applies, so you don’t have to disclose any gains or losses to the tax office.

However, if it was an investment property or a rental, things get a bit more complicated. You’ll need to consider capital gains tax, which is calculated based on the difference between the purchase price and the sale price, minus any costs like legal fees and agent commissions. If you held the property for more than a year, you can apply a 50% capital gain discount, which is a nice little perk.

If you need help navigating the tax implications, it might be a good idea to consult with a tax professional. Gotax can help you sort out all the details and ensure you’re meeting all the ATO’s requirements. Cheers!

You’ll need to include any payments received under your Income Protection Insurance policy as income in your tax return. When you're using GoTax, they make it pretty straightforward. Once you’re logged in, you’ll be guided through the process of entering your income and deduction information.

To claim Income Protection expenses simply go to the expenses list and select Income Protection. It's the last expense item.

If you’re unsure about where exactly to input this, GoTax has live chat support available on their website to help you out. And don’t forget to regularly review your income protection policy to ensure you’re getting the tax deductions you deserve.

If you need more detailed guidance, just head over to gotax.com.au and they’ll sort you out!

...it doesn't directly affect your tax-free pension. If you're over 60 and retired, any money you take out from your super fund is generally tax-free, provided the fund has already paid tax on it. However, the interest earned from other sources, like savings accounts or investments, does need to be declared as income on your tax return. This interest income is separate from your super pension and will be assessed according to your marginal tax rate. If you have any specific concerns, it's always a good idea to chat with a Gotax professional or use a service like GoTax to get tailored advice. Cheers!

... and you're looking to declare interest earned, you can definitely do that. Even though your pension is tax-free, any interest you earn from savings accounts or other investments still needs to be declared as income.

If you haven't provided your Tax File Number (TFN) to your bank, they might withhold tax on the interest at a rate of 47%. You can claim this withheld tax back when you file your tax return. Using an online tax service like Gotax can make this process easier. Just enter your income, including the interest earned, and any tax withheld, and Gotax will help you calculate your refund.

If you have any specific questions or need personalised advice, it's always a good idea to contact a Gotax professional who can evaluate your circumstances and provide accurate guidance. Cheers!

...but have earned interest over the tax-free threshold, you'll need to declare that interest as part of your taxable income. Here are a few steps you can take:

If you're unsure about any of these steps, Gotax can help you out. They offer friendly and cost-effective tax return services, and you can start your tax return with them at any time. Cheers!

If you're looking to claim your Qantas Club membership fees as a tax deduction, the Australian Tax Office (ATO) has some specific rules.

If the membership is used for both business and private travel, you can only claim the portion used for business. For example, if you took 100 flights in a year and used the lounge for 80 business-related flights, you could claim 80% of the membership fee as a deduction.

Just remember to keep detailed records, like a comprehensive business travel diary, to back up your claims. If you're ever unsure, it's always a good idea to consult with a Gotax professional. Gotax, for instance, offers some handy tools and advice to help you navigate these waters. Cheers!

If you're looking to lodge your tax return with GoTax, they offer a couple of options. For a quick income tax return, it's just $15. If you need a more comprehensive service, the "Income Tax Return with the lot" is $55. And if it's your first time lodging a tax return, you can actually do it for free! So, plenty of options to suit your needs and budget.

...on your taxable income for the financial year. It’s calculated by applying the relevant tax rates to your taxable income, which is your total income minus any allowable tax deductions. For example, if you have a taxable income of $26,800, the tax payable would be calculated based on the tax rates for that income bracket. In Australia, for income between $18,201 and $45,000, the tax rate is 19 cents for each dollar over $18,200. So, for $26,800, the tax payable would be ($26,800 - $18,200) x 0.19 = $1,524.

...a trustee holds and manages assets for the benefit of the beneficiaries, who are usually family members. It's often used for asset protection and tax planning.

When it comes to taxes, if a family trust distributes income to its beneficiaries, the beneficiaries need to declare that income on their tax returns. Additionally, if the trust pays a family trust distribution tax, that amount is also considered when calculating things like the Medicare Levy Surcharge (MLS).

For example, if your family trust has paid distribution tax, that amount will be added to your income when determining if you need to pay the MLS. The MLS is a surcharge on your taxable income if you don't have an appropriate level of private hospital cover and your income exceeds certain thresholds.

If you're managing a family trust or are a beneficiary, it's a good idea to keep detailed records and perhaps consult with a tax professional to ensure you're meeting all your obligations and making the most of any potential tax benefits. Gotax can help you navigate these waters and ensure you're on the right track!

You can only claim laundry expenses for work-specific clothing, such as uniforms with your employer's logo or protective clothing.

Deductible: You can claim a deduction for the cost of laundering non-compulsory uniforms only if they are registered with AusIndustry. Non-compulsory uniforms are those that your employer encourages you to wear but does not strictly enforce.

Not Deductible: If the non-compulsory uniform is not registered with AusIndustry, you cannot claim a deduction for the cost of buying, hiring, repairing, or laundering it.

... which specifies the remote and isolated areas classified as Zone A or Zone B, on the Australian Taxation Office (ATO) website. Here is the link to the relevant section on the ATO website where you can locate the zone listings:

Zone Tax Offset List

To qualify for the Zone Tax Offsets, you need to meet the following criteria:

These criteria ensure that only those who genuinely reside in remote or isolated areas for a significant portion of the year can claim the offset.

Remember, you need to have lived in the designated zone for more than half a year (183 days) to qualify for the offset. If you're still unsure, you can always reach out to Gotax through their messaging system for more personalised assistance.

Gotax is a registered Tax Agent with the Tax Practitioners Board, and their Tax Agent Number (TAN) is 25498770. If you need any more details or have other questions, feel free to ask! or Contact the Tax Practioners' Board.

... is typically provided by your employer and is also available through the ATO's online services. Employers are required to finalize these by July 14 each year.

Once the employer finalises it, you can access it through your myGov account linked to the ATO.

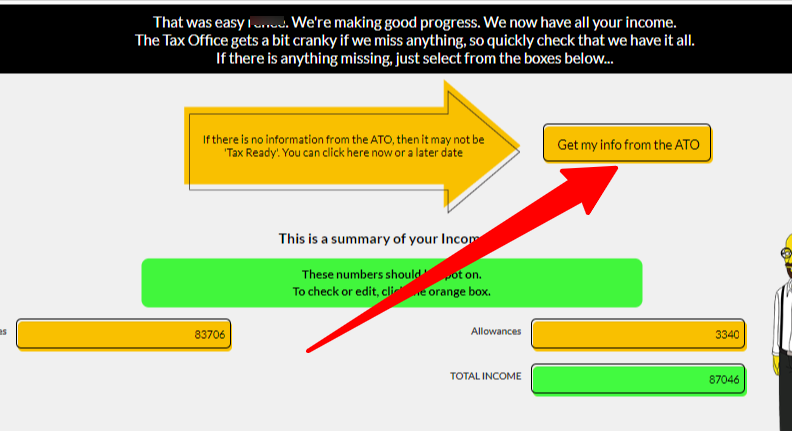

Gotax provides an automatic prefill of your Income Tax Return with your Group Certificates (Income Statements). Simply set up an account, fill in your details and watch it all happen.

Just Log In to your account

You are given a series of boxes with Options.

Select the "Complete an unfinished Tax Return?" Box

To locate the expense page you are looking for.....

.... just click the left and menu to navigate around.

It's not a preferred option and any issues you think are serious can probably be fixed with a bit of help and guidance.

It's not a preferred option and any issues you think are serious can probably be fixed with a bit of help and guidance.

As a last resort we can delete your return if need be. Security measures are installed to prevent deletion of clients Income Tax Returns.

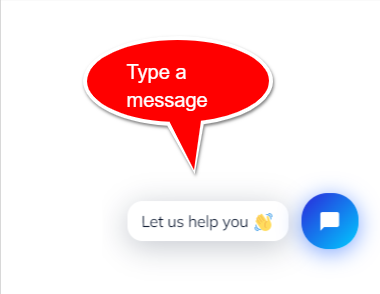

The BEST way to ACTION this is simply get on to the Gotax Chat Bot (Bottom Right Hand Corner).

Tell us who you are so we can look at your Tax Return whilst you're online.

Specify what issues you are having.

If no one is home on the Chat Bot leave your details and we will get back to you.

You CANNOT delete your Income Tax Return. Internal security measures prevent that from occurring.

We can do that for you after we assess what's going on or what's causing your issues. It's usually a last resort option.

What you need to do now is get onto the Chat Bot (Bottom Right), type in your name, the problem you're having and see if we can walk you through a solution.

... to process your tax return and release your refund. However, during peak periods like July to October and holiday periods such as Christmas and Easter, there might be some delays.

In most cases, the ATO aims to process all tax returns within 20 days. If you choose to have Gotax's fee deducted from your refund, you should allow an additional 24 hours for this to be processed.

So, generally, you can expect your refund within 7-14 days after lodging your tax return, but it could take up to 20 days or more in extreme cases.

Remember, you must have spent the money yourself, it must be directly related to earning your income, and you must have a record to prove it.

If you work from home as part of your job and incur additional expenses because of it, you can claim these work-related expenses on your tax return. There are two main methods to calculate your claim:

Additionally, during the period from March 2020 to June 2020, there was a special rate of 80 cents per hour that bundled all home office expenses into one claim. You didn't need a designated office space, and more than one person in the household could claim it. You just needed to keep a diary, timesheets, or logbooks tracking the hours worked from home.

Remember, if you choose the 80 cents per hour method, you cannot claim other work-from-home costs separately. For the other methods, detailed records and receipts are essential to substantiate your claims.

FBT stands for Fringe Benefits Tax, which is a tax employers pay on certain benefits they provide to their employees, including their employees' family or other associates. The benefits can be in addition to, or part of, their salary or wages.

There are two categories based on the employer's status regarding FBT exemption:

If you have any specific questions or need more detailed advice related to your circumstances, it's recommended to contact a professional who can provide tailored assistance.

If you've forgotten your username for GoTax, you should contact their support team for assistance. You can reach them by emailing youareimportant@gotax.com.au or by calling 07 3881 0942. They should be able to help you recover your username. Remember to have any relevant information handy that might help verify your identity.

...there are several important aspects to consider to ensure you maximize your deductions and minimise your tax liability. Here’s a comprehensive breakdown:

By carefully managing your rental property expenses and understanding the available deductions, you can effectively reduce your taxable income and maximise your tax return. If you’re unsure about any aspect, consulting a Gotax professional can provide clarity and ensure you’re compliant with tax regulations.

If you believe there is an error, it's best to review your tax return and ensure all information is correct. You may also want to contact the ATO for further assistance.

.... it depends on a few factors such as your taxable income, the deductions you can claim, and your tax bracket.

For example, if your income is $65,000 for the year, you fall into the 34.5% tax bracket (including the Medicare Levy). If you spent $1,000 on deductible items like small tools, you would get $345 back in your tax refund.

However, if you are in the highest tax bracket, you would get back $495, and if your tax rate is NIL (Zero), you wouldn’t get anything back.

The only way to get an accurate refund estimate is to actually do your tax return.

If you use services like GoTax, they offer tools and professional advice to help you maximise your refund.

... you can claim as tax deductions on your tax return. Here’s a detailed list of common deductions you may be able to claim:

However, there are certain expenses you cannot claim, including:

Remember, to claim any of these deductions, you must have spent the money yourself, the expense must be directly related to earning your income, and you must have records to prove it. If you’re unsure about any specific deductions, it’s always a good idea to consult with a tax professional or refer to the ATO’s guidelines for more information.

Remember, it’s crucial to keep accurate records and receipts for all the expenses you intend to claim. If you’re unsure about any specific deductions, it’s always a good idea to consult with a Gotax professional.

Sure! A meal allowance is an amount your employer pays you to cover the cost of your meals while you are working, particularly during overtime. This allowance is typically paid under an industrial award or enterprise agreement and must be shown on your income statement, which you then declare as income in your tax return.

For the 2022-23 financial year, the Australian Taxation Office (ATO) considers an overtime meal expense claim of up to $33.25 per meal to be reasonable without requiring receipts. If you spend more than this amount, you must keep receipts for your expenses. For the 2023-24 financial year, this reasonable amount has been updated to $35.65 per meal.

You can only claim the actual amount you spend on your meal, not the amount of the allowance. If your meal allowance is not included in your Payment Summary but is shown on your payslip, you can claim the difference between what you spent and the allowance shown on your payslip. Remember to keep all receipts and records of your expenses to substantiate your claims, unless you meet the exception conditions for record-keeping.

If you need further assistance, it's always a good idea to contact a registered tax agent like Gotax for personalized advice.

Handling a deceased estate tax return can be a complex process, but it's essential to ensure that the tax obligations of the deceased are appropriately managed. Here's a general overview of what needs to be done:

For more detailed guidance, you can refer to the Australian Taxation Office (ATO) website or consult with a professional tax service like GoTax, which can provide tailored advice and assistance for managing deceased estate tax returns.

Overall, having a Quantity Surveyor prepare a depreciation report for your rental property is a valuable investment that can help you maximise your tax deductions and improve your financial returns.

A depreciation schedule is a detailed report that outlines the depreciation of assets over time. It is typically used for tax purposes to claim deductions for the decline in value of assets. Here’s how it works:

A well-prepared depreciation schedule can significantly reduce your taxable income by allowing you to claim deductions for the decline in value of your assets over time.

Child support is considered a personal expense rather than a work-related expense, and therefore, it cannot be claimed as a deduction on your tax return. If you need more personalised advice, it's always a good idea to consult with a qualified Gotax professional.

Child support payments are not included in your assessable income for tax purposes, and they are not tax deductible. This means that if you are receiving child support, you do not need to report it as income on your tax return. Similarly, if you are making child support payments, you cannot claim them as a tax deduction.

The rationale behind this is that child support is considered a private or family expense rather than a business or income-related expense.

.... that allows you to automatically download your income and other relevant tax information from various sources directly into your tax return. This can include details from your employers, banks, government agencies, and other institutions that report to the ATO.

At GoTax, we make use of this prefill option to ensure that all your income details are accurately captured. However, it's still a good idea to have all your documents and receipts on hand to verify that everything is correct. The ATO usually makes all prefill data available after mid-July, so if you're lodging your return before then, some information might not be available yet.

When you use GoTax to lodge your tax return, we review and check all the prefilled data before we lodge it for you, making the process simple, secure, and convenient. You can also use our Deduction Grabber App to keep track of all your tax-related information throughout the year, which can further streamline the process when it's time to lodge your return.

Gotax.com.au Australia's easiest, cheapest, smartest .. Phoebe Ai online tax service. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+

Gotax.com.au Australia's easiest, cheapest, smartest .. Phoebe Ai online tax service. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+Generally, travel expenses between your home and your point of hire are considered private and not deductible under S.8-1. This is because the travel is viewed as "to work" rather than "on work."

However, if your employer pays for these travel expenses, the employer may be subject to Fringe Benefits Tax (FBT), and the employer could potentially apply the "otherwise deductible rule" to reduce the FBT liability, provided certain conditions are met.

For example, if your travel arrangements have characteristics similar to those in the John Holland case, where employees were under the employer's direction and control from the point of hire, then the travel might be considered as occurring "on work."

But if you are paying for these expenses yourself, they are generally not deductible because they are considered private in nature.

...you need to fall into one of the specific categories outlined by the Australian Tax Office. Here are the main categories for exemptions:

To apply for an exemption, you typically need to provide documentation showing your entitlement. This could include a Medicare Entitlement Statement, proof of foreign residency, or other relevant documents.

It's important to note that these exemptions are separate from the Medicare levy reduction, which is based on your income level and other circumstances. Always consult with a tax professional or accountant to understand your specific situation and ensure you are meeting all requirements for an exemption.

Remember, it’s crucial to keep accurate records and receipts to support your claims and avoid any potential penalties from the ATO. Using tools like the Deduction Grabber App can help you keep track of your expenses and ensure you don't miss out on any deductions. If you’re unsure, it’s always a good idea to consult with a Gotax professional.

.... so he's a heads up on the way it happens and how to avoid a "Lock Out" situation.

And what does that mean...

It means you will be locked out of the system for 30 minutes, before you can try again.

So let's make this simple:

If you consistently use the same user name and password and it didn't work the first time, there is really zero use in having another two cracks without changing something.

Either your Username is wrong or your Password is wrong.

Great, if you don'y know your UserName, try your TFN, so if we try to login and it fails, the rational conclusion is that it's a password issue.

Have another go and if login fails again, then that's strike two.

Step back and have a think, don't risk another crack at your password, time to reset it with the "Forgot Password" prompt that's where the login is.

Password reset, new password, enter username, enter new password and woo hoo, you should be right to go.

Don't forget that your Tax File Number (TFN) can be used INSTEAD of your username if required.

Now that you're logged in you can sit back, relax and enjoy doing your tax return (if there is such a thing).

If you're a small business owner, you might be looking at managing employees, handling payroll, and ensuring compliance with various regulations. On the other hand, as a contractor, you would be more focused on managing your own work, finding clients, and possibly handling your own tools and equipment.

For small businesses, tools like eCashbooks can simplify bookkeeping by allowing you to record money in and out, create quotes and invoices, and handle BAS if needed. This can make managing your finances much easier without needing to hire a costly bookkeeper.

Contractors, on the other hand, need to understand the distinction between being an employee and a contractor for tax purposes. For instance, contractors have the freedom to engage others to perform work, bring their own tools, and are responsible for fixing their own mistakes. Employees, however, receive tools from their employer, cannot delegate their work, and are not personally liable for mistakes made during work.

Additionally, there are government incentives and support available for both small businesses and contractors, such as wage assistance for apprentices and trainees, tax-free payments to boost cash flow, and increased depreciation deductions.

In summary, whether you identify as a small business or a contractor, there are resources and support systems in place to help you manage your operations effectively.

Here are some common deductions you might be eligible for:

Remember to keep detailed records and receipts for all your expenses to substantiate your claims. If you're unsure about any specific deductions, consulting a Gotax professional or using a service like GoTax can help ensure you maximise your deductions and comply with tax laws.

....if you follow the methods and rules set by the Australian Taxation Office (ATO).

There are two main methods to calculate depreciation: the prime cost method and the diminishing value method.

Example Depreciation Prime Cost:

Example Depreciation Diminishing Value:

You can choose either method depending on your situation and preference, but you must stick to the same method for the same asset for its entire effective life. To make the process even easier, the Gotax Online System has all the depreciation Built in. Just add your asset and date you acquired it and Gotax will do the rest. Yep it's that easy.

...you fall below the tax-free threshold of $18,200. This means you are not required to pay any income tax. However, if your employer has withheld any tax from your pay, you would be entitled to get that amount back when you lodge your tax return.

Since you are under the tax-free threshold, you would not owe any tax, and you would receive a refund of any tax that was withheld from your pay. If no tax was withheld, you would not receive a refund, but you also would not owe any tax.