Tax Tips for Receptionists

Tax Tips for Receptionists – Maximise Your Refund with Simple Claims

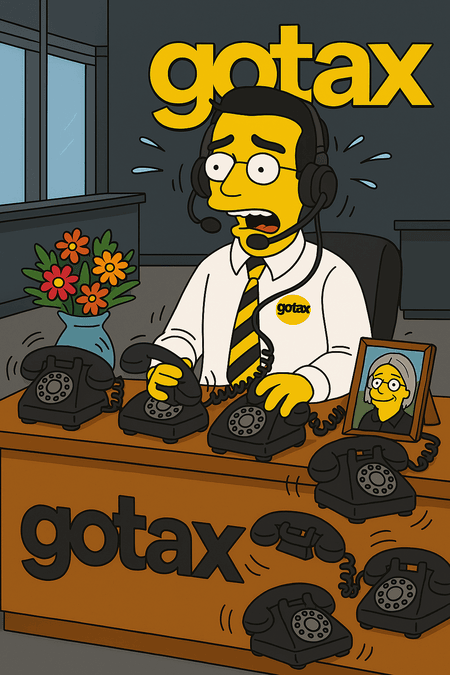

Receptionists can claim tax deductions for uniforms, training, phone, internet, stationery, and more. GoTax makes it easy to finalise your tax return online and boost your refund.

What Receptionists Can Claim on Their Tax Return

Receptionists spend a lot keeping the front desk running — from uniforms and phone calls to extra training and home office costs. The good news? Many of these are tax deductible. The trick is knowing what counts, what doesn’t, and keeping proof. GoTax makes the whole thing simple.

Common Receptionist Tax Deductions

| Expense Type | Examples Receptionists Can Claim |

|---|---|

| Uniforms & Laundry | Branded uniforms with company logo, cleaning costs |

| Phone & Internet | Work calls, emails, rostering apps |

| Stationery & Supplies | Pens, diaries, notepads, desk organisers |

| Training & Courses | Computer training, customer service courses |

| Union & Professional Fees | Union dues, professional memberships |

| Computer & Equipment | Laptops, tablets, headsets used for admin tasks |

| Home Office Costs | Internet, electricity, desk use when working from home |

| Travel | Trips between offices, training venues, or banking errands |

| Income Protection Insurance | Premiums that cover loss of income |

FAQs for Receptionists

Can receptionists claim uniforms and laundry?

Yes. You can claim branded uniforms with logos and the cost of washing them. Regular clothes don’t count.

Can receptionists claim phone and internet?

Yes. If you use your personal phone or internet for work calls, emails, or apps, you can claim the work portion.

Can receptionists claim stationery?

Yes. Work-related items like pens, notebooks, or diaries are deductible.

Can receptionists claim training courses?

Yes. Training that improves your receptionist role — like Microsoft Office or customer service — is deductible.

Can receptionists claim professional fees?

Yes. Memberships or union fees directly related to your role are deductible.

Can receptionists claim home office costs?

Yes. If you work from home, you can claim electricity, internet, and work-related desk use.

Can receptionists claim travel expenses?

Yes. Travel between offices, banks, or training venues is deductible, but normal home-to-work travel is not.

Can receptionists claim laptops or tablets?

Yes. Devices used for admin, scheduling, or work communication are deductible, but private use must be apportioned.

Can receptionists claim income protection insurance?

Yes. Premiums for income protection policies are deductible.

Can receptionists claim meals?

Only if you’re travelling overnight for work and not reimbursed.

Receptionist Tax Checklist

-

ABN Registered (if contracting)

-

All Income Declared

-

Business Expenses Claimed

-

Home Office Costs Sorted

-

Super Contributions Considered

-

GST Registered (if earning $75,000+)

-

eCashbooks in Use

-

Bank Account Separated

-

Receipts Saved Digitally or on Paper

-

Records Kept for 5 Years

Receptionists keep the office moving, but your tax return doesn’t have to be another job. GoTax makes it fast, easy, and cheap to finalise your tax return online. Claim every deduction you’re entitled to and maximise your refund at www.gotax.com.au.