Tax Tips for Hair & Beauty Workers

Beauty Isn’t Cheap, But Your Tax Return Can Be

From cutting foils to cutting costs, hair and beauty professionals are always juggling a dozen things at once. So it’s no surprise that many miss out on some of the most common (and powerful) tax deductions available.

If you’ve spent money to do your job—there’s a good chance the ATO will let you claim it back. And with GoTax, you can do it all online, from as little as $65.

Here’s your salon-smart guide to getting a bigger refund this year.

Claimable Expenses for Hair & Beauty Professionals

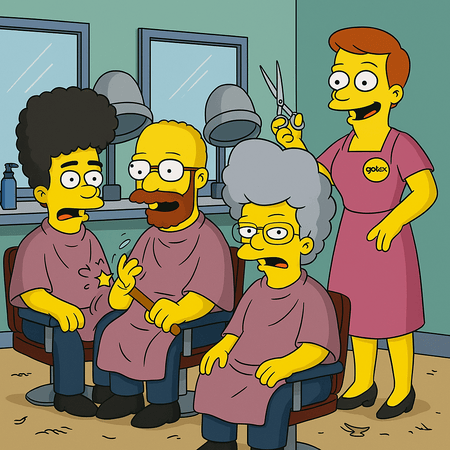

Work Uniforms and Aprons

If your uniform has your boss’s logo, you’re good to go. You can claim a tax deduction for the cost of purchasing, repairing, and laundering workwear—but only if it qualifies.

Aprons and protective clothing are claimable as tax deductions as well, especially when they’re required for your daily work.

You can’t claim basic fashion items like black pants or plain shirts—even if they’re your salon standard.

Tools of the Trade

Those scissors weren’t cheap—and neither are straighteners, curlers, waxing kits, mirrors, and massage tools.

If it’s under $300, you may be able to claim as a tax deduction the full cost immediately. Over $300? You’ll need to depreciate the item over time.

Also claim tax expenses for tool maintenance, batteries, and parts.

Work Travel (Not the Commute)

Travel between salons? Off to pick up stock or run errands? That travel is potentially claimable.

What’s not claimable? Your usual trip from home to your regular workplace.

You’ll need to either:

-

Log 12 weeks of trips in a logbook and claim a percentage of car costs

-

Or use the ATO’s cents-per-kilometre method (up to 5,000km)

Internet, Phone & Admin Time

Answering client calls, managing bookings, or promoting yourself on socials? If you're using your phone or internet for work—you can claim a portion of the cost.

If you have a dedicated home workspace for admin or online bookings, you can also claim electricity and supplies.

Keep a one-month usage diary to work out your business use percentage.

Training, Courses & Upskilling

Staying sharp in the beauty world often means paying for courses, seminars, and certifications.

The good news? If it’s related to your current role, you can claim the fees—and associated costs like textbooks, stationery, and travel.

Just remember: courses that qualify you for a new career path aren’t deductible.

Commonly Missed Tax Deductions

Here are a few extras hair and beauty pros forget every year:

-

Income protection insurance (paid personally)

-

Union or industry association fees

-

Donations to registered charities

-

Personal super contributions (for sole traders)

Run Your Own Business or Side Hustle?

Got an ABN? You may be able to claim even more—like business insurance, marketing costs, client gifts, and equipment used at home or in a mobile setup.

GoTax makes ABN returns simple, fast, and affordable.

Only $140 for a full small business return handled by real tax agents.

Click here to start your ABN tax return

Make It Easy with the Deduction Grabber App

Tired of chasing receipts? GoTax’s free Deduction Grabber App makes it easy to:

-

Log expenses and tools

-

Track car kilometres

-

Snap and store receipts instantly

No more shoebox full of receipts. Just one slick app and a better refund.

Final Word: Get the Refund You Deserve

You help people feel confident. Now it’s your turn to feel confident about your tax return.

With the right info, a smart system, and a cheeky little assistant named Derek—you can claim what’s rightfully yours.

Call to Action

Sign up to GoTax and not only get your Tax Return done, you can also ask as many questions as you like and get informed answers. You have access to the equivalent of a Tax Einstein – that is our very own D.e.r.e.k as well as the best credentialed Tax Accountants around.