Tax Tips for Factory & Warehouse Workers

Tax Tips for Factory Workers – Maximise Your Refund in 2025

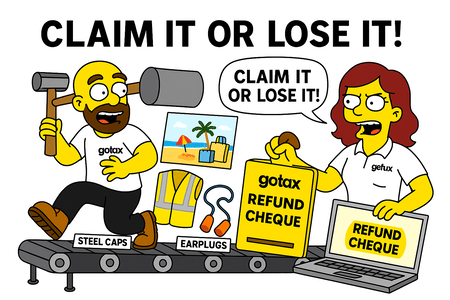

On your feet all day? Hairnet glued on? Staring down the line, dreaming of a decent tax refund? We see you, factory legends. The good news is, you’re probably missing out on hundreds of dollars in tax deductions.

Let Gotax break it all down and get your refund roaring like a conveyor belt on double time.

-

Uniforms & Protective Clothing

-

Tools & Equipment (Claiming the Right Way)

-

Other Deductions You May Be Missing

-

Top 5 Q&As for Factory Workers

-

ATO’s Golden Claiming Rules

-

Use the Gotax Deduction Grabber App

-

Helpful Blogs & Videos

-

Final Tips

1. Uniforms & Protective Clothing

You can claim the cost of buying, washing, or repairing uniforms with your employer’s logo.

No logo? No deduction. That plain Kmart hoodie doesn’t count.

Protective Clothing (PPE) You Can Claim:

-

Steel cap or waterproof boots

-

Hard hats

-

Gloves

-

Masks or hair nets

-

High-vis wear

-

Ear plugs or muffs

-

Protective glasses

Laundry Tip: Keep a diary of how often you wash your gear—it can really add up. Gotax helps you track that too.

2. Tools & Equipment (Claiming the Right Way)

Using your own tools on the job? Here’s how it works:

-

Under $300: Claim the full cost straight away

-

Over $300: You’ll need to depreciate it over a few years (don’t worry, Gotax works this out for you)

Examples:

-

Torque wrenches

-

Precision knives

-

Tool belts

-

Specialised measuring devices

And yes—you can also claim batteries, repairs, and servicing on your tools.

3. Other Deductions You May Be Missing

Here’s a common list of work-related deductions that factory workers often forget:

-

Union fees: If you're a member—claim it.

-

Tax agent fees: Yep, even the one for last year.

-

Donations: Only if made to a registered charity.

-

Income protection insurance: If you pay it yourself (not through super).

-

Stationery: For recording hours, stock levels, or procedures.

-

Licences: Special work licences like a forklift licence or confined spaces training.

4. Top 5 Q&As for Factory Workers

Q1: Can I claim travel to and from work?

Answer: Not usually—unless you’re carrying bulky tools with nowhere secure to store them onsite.

Q2: Is overtime meal money claimable?

Answer: Only if your award entitles you to a meal allowance and you’ve spent the money. Keep the receipt and check your payslip.

Q3: I wear a hairnet and gloves every day—can I claim them?

Answer: If your employer requires them and you bought them yourself—yes. If they supply them—nope.

Q4: Can I claim my flu shot or physio?

Answer: Unless it’s directly required by your employer or you work in a high-risk health environment—nope. Personal health = personal cost.

Q5: Do I need receipts for everything?

Answer: Not for everything, but the more proof you have, the better. Bank statements, invoices, diary entries, even photos of purchases can help.

5. ATO’s Golden Claiming Rules

To claim it, the ATO says:

-

You paid for it (not reimbursed)

-

It directly relates to your work

-

You’ve got a record

No guesswork. No “I think I can.” Just facts and proof.

6. Use the Gotax Deduction Grabber App

Don’t let your deductions disappear down the drain.

The FREE Gotax Deduction Grabber App helps you:

-

Snap & store receipts

-

Track vehicle trips

-

Record laundry and PPE costs

-

Keep all your records in one place

Available on App Store and Google Play — just search “Deduction Grabber”

7. Helpful Blogs & Videos

Blogs

???? Videos

8. Final Tips from Derek

You show up. You work hard. You sweat it out. Don’t short-change yourself at tax time.

Keep your receipts. Know your rights. And if in doubt—just ask Derek below.

Our Tax Blogs -

Factory Workers Tax Deductions

Can I Claim my Uniform on my Tax Return?

Can I Claim Boots on my Tax Return?

Our Tax Videos -