September 21, 2024

How Much of Your Internet Can You Claim?

Many of us rely on the internet for work, study, and even running a business from home. But how much of your internet expenses can you claim as a tax deduction? Let's break it down for you, while identifying potential traps and providing real-life examples.

Claiming Internet Expenses

-

Work-Related Use:

- If you use the internet for work-related purposes, you can claim as a tax deduction the portion of your internet expenses that directly relates to your work. This includes tasks like checking work emails, conducting research, or participating in online meetings.

-

Home Office:

- If you have a dedicated home office space and use the internet for work, you can claim a portion of your internet expenses based on the percentage of time you use the internet for work purposes as a tax deduction.

-

Running a Business from Home:

- If you run a business from home, you can claim a portion of your internet expenses as a tax deduction. This includes activities like managing your business website, communicating with clients, and conducting online transactions.

Traps to Avoid

-

Mixed-Use:

- Be cautious when claiming internet expenses if you use the internet for both work and personal purposes. You can only claim as a tax deduction the portion that is directly related to your work or business. For example, if you use the internet 50% for work and 50% for personal use, you can only claim 50% of your internet expenses.

-

Lack of Records:

- To claim internet expenses, you need to keep accurate records of your usage. This includes keeping a log of the hours you use the internet for work and personal purposes. Without proper records, your claim may be disallowed as a tax deduction.

-

Overestimating Usage:

- Avoid the temptation to overestimate your work-related internet usage. The Australian Taxation Office (ATO) may scrutinise your claim, and if it seems unreasonable, you could face penalties.

Examples

-

Tax Deductible: Emma works from home as a graphic designer. She uses the internet 70% of the time for work-related tasks and 30% for personal use. Emma can claim 70% of her internet expenses as a tax deduction.

-

Not Tax Deductible: James occasionally checks his work emails from home but primarily uses the internet for streaming movies and social media. Since the work-related use is minimal, James cannot claim his internet expenses as a tax deduction.

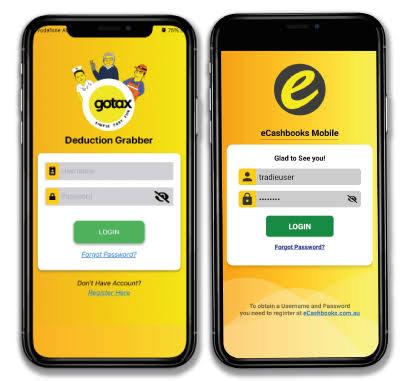

Gotax Deduction Grabber App

Maximise your tax deductions with the Gotax Deduction Grabber App. This app has all the logbooks and tax expense recording systems you need to keep track of your deductible expenses. Simply scan the QR code to download and start saving today!

Gotax Piece of Tax Advice

Leverage Technology for Accurate Claims: Use apps and tools to track your internet usage accurately. Many routers and internet service providers offer usage reports that can help you determine the exact percentage of your internet use for work purposes. This ensures your claims are accurate and compliant with ATO guidelines.

Leave a Comment