May 27, 2024

Foreign Income and your Tax | Tax Online

What you need to know about Foreign Income and your Income Tax Return.

Foreign income on your tax return can be a bit complex, but at Gotax we can help clarify things for you. Here’s what you need to know:

Do I need to declare foreign income?

Do I need to declare foreign income?

- Types of foreign income to declare

- Foreign income already taxed

- Foreign income not taxed

- Foreign currency conversion

- How to declare foreign income

- Documentation

Do I need to declare foreign income?

Yes, as an Australian resident for tax purposes, you are required to declare all your worldwide income, including foreign income, on your income tax return. This includes income that has already been taxed in another country

Types of foreign income to declare:

- Employment income: Wages or salary earned while working overseas.

- Business income: Profits from business activities conducted overseas.

- Investment income: Interest, dividends, or rental income from overseas investments.

- Capital gains: Profits from selling foreign assets.

- Pensions and annuities: Payments received from foreign pension funds or annuities.

- Foreign income already taxed: If your foreign income has already been taxed in the country where it was earned, you may be eligible for a foreign income tax offset (FITO) to avoid double taxation. The FITO allows you to claim a credit for the foreign tax paid, up to the amount of Australian tax payable on that same income.

Foreign income already taxed

If your foreign income has already been taxed in the country where it was earned, you may be eligible for a foreign income tax offset (FITO) to avoid double taxation (Gotax works this out for you). The FITO allows you to claim a credit for the foreign tax paid, up to the amount of Australian tax payable on that same income.

Foreign income not taxed

If some of your foreign income hasn’t been taxed overseas, you will need to declare the full amount on your income tax return and pay the applicable Australian tax on it.

Foreign currency conversion

Any foreign income must be converted into Australian dollars (AUD) using the exchange rate that applied at the time you received the income. The Australian Taxation Office (ATO) provides exchange rates for this purpose, or you can use a reliable source such as the exchange rates published by the Reserve Bank of Australia.

How to declare foreign income

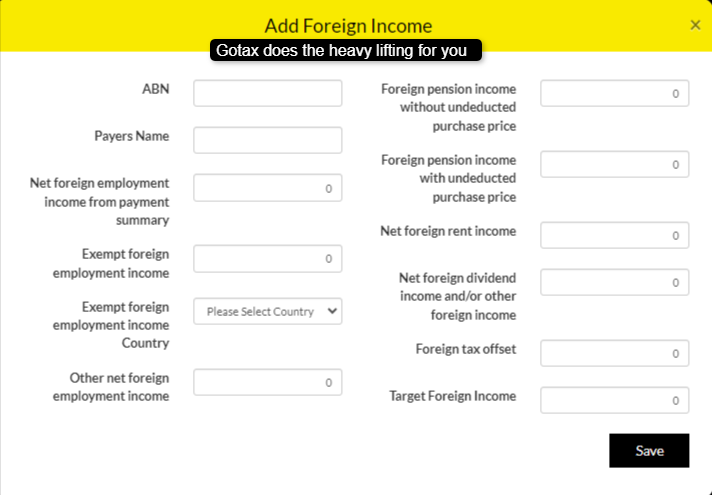

Log into gotax.com.au. We've made it easy for you. Just fill out the prompts and ask our TaxAi if you're unsure.

Tax Documentation Required

Ensure you keep detailed records of your foreign income and any taxes paid overseas, including:

- Foreign tax returns

- Payment summaries or payslips

- Bank statements showing the receipt of income

- Documentation of exchange rates used

If you’re uncertain about any specifics or need personalised advice, it’s always a good idea to consult with Gotax.

Leave a Comment