October 17, 2024

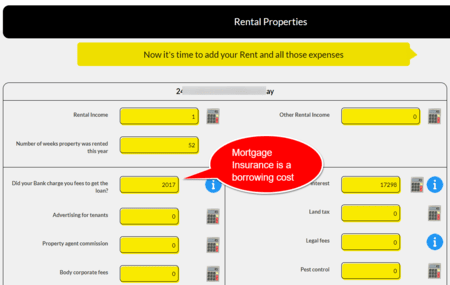

Lender's Mortgage Insurance (LMI) is a common requirement for borrowers....

who have a lower deposit when purchasing a property. While it protects the lender in case of borrower default, understanding the tax implications of LMI is crucial, especially for investors. Let's look at when LMI is deductible, how it is apportioned, and specific scenarios including construction projects.

When is LMI Deductible?

LMI is generally deductible for investment properties, as it is considered a borrowing expense incurred in the process of generating assessable income. However, it is not immediately deductible in full. Instead, LMI must be apportioned over the lesser of five years or the term of the loan.

For ordinary homeowners who occupy the property as their primary residence, LMI is not deductible. The deduction applies only to properties that are used to produce rental income.

Apportioning LMI

If you acquire the loan part way through the year, the deduction for LMI must be prorated based on the number of days in the year you held the loan. This ensures that the deduction accurately reflects the period during which the property was generating or intended to generate income.

LMI for Construction Projects

For construction projects, the deductibility of LMI can be a bit more complex. If you take out a loan for a construction project that takes, for example, 14 months to complete, the LMI is still deductible over five years or the loan term, whichever is shorter. However, the deduction can only commence once the property is available for rent. This means that during the construction phase, you cannot claim the LMI deduction until the property is completed and ready to produce rental income.

Example Calculation

Let's say you have an LMI expense of $5,000 for a loan intended for an investment property. If the loan term is 10 years, you would apportion the LMI over five years.

- Annual Deduction:

- Total LMI = $5,000

- Deduction Period = 5 years

- Annual Deduction = $5,000 / 5 = $1,000 per year

If the loan was acquired part way through the year, say on July 1, you would prorate the deduction for that first year based on the number of days you held the loan.

Conclusion

Understanding the deductibility of Lender's Mortgage Insurance is essential for investors looking to optimise their tax position. While LMI is not deductible for owner-occupied homes, it can be a valuable deduction for investment properties, provided it is apportioned correctly. For construction projects, timing is key, as deductions can only begin once the property is ready to generate income. By navigating these rules effectively, investors can ensure they are maximising their tax benefits.

Gotax.com.au Australia's easiest, cheapest, smartest .. Phoebe Ai online tax service. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+

Leave a Comment