August 17, 2025

Tax Returns 2025 – Your Ultimate Guide to Maximise Refunds

Introduction – Tax Time Doesn’t Have to Be Painful

It’s that time again — tax season in Australia. The ATO is sharpening its pencils, etax is whispering boring bedtime stories, and your refund is waiting to be claimed.

But here’s the thing: 2025 brings new rules, new traps, and new opportunities. Whether you’re juggling a side hustle, renting out a property, running a small business, or just trying not to get smacked with an ATO fine, you need a tax game plan.

This guide covers the latest changes, the most common mistakes, and answers the top 20 questions Aussies are asking about their 2025 tax return. More importantly — it shows you how Gotax makes it faster, cheaper, and easier than anywhere else.

Ready? Gotax will guide you.

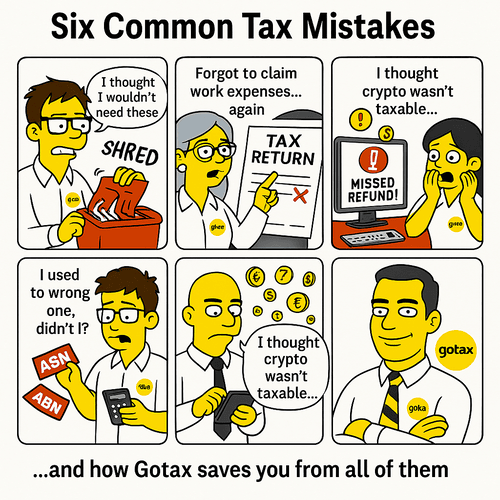

Common Mistakes That Cost Aussies Big in 2025

-

Forgetting to declare gig income (Uber, Deliveroo, Airbnb – the ATO has eyes everywhere).

-

Missing tax deductions for working from home.

-

Not keeping receipts (pro tip: if your dog ate it, the ATO doesn’t care).

-

Overlooking the $20,000 instant asset write-off for small business.

-

Forgetting crypto trades — yes, even that dodgy coin you panic-sold.

-

Misreporting rental property expenses (ATO loves auditing these).

-

Confusing personal and business expenses.

-

Missing the tax deadline (the ATO has late fees nastier than a parking inspector).

What’s New for Tax Returns in 2025?

-

$20,000 Instant Asset Write-Off extended for small businesses.

-

Capital gains tax reporting tightened — shares, property, crypto, you name it.

-

Foreign resident withholding rules updated.

-

More focus on rental property claims — repairs vs. capital improvements are a hot audit trigger.

-

Work-from-home fixed rate rules still apply — but you need real records.

The Top 20 Tax Return 2025 Q&As

When is the deadline for lodging my 2025 tax return?

For most individuals it’s 31 October 2025. If you’re with a tax agent like Gotax, you may get more time.

Can I claim work-from-home expenses?

Yes. Either use the fixed rate method or actual expenses — but records are king.

What’s the instant asset write-off?

Small businesses can immediately deduct assets under $20,000 bought and installed between 01/07/24 and 30/06/25.

Do I need to declare Uber, Airbnb, or gig income?

Yes. Every dollar. The ATO is tracking it — don’t risk it.

How do I claim home office deductions?

Fixed rate per hour or actual running costs — but you must keep proper logs and receipts.

What are the most common ATO audit triggers?

Rental property claims, big spikes in deductions, and undeclared gig income.

Can I claim crypto losses?

Yes, but only if you’ve sold or disposed of it in 2025.

What if I make a mistake in my tax return?

You can amend online through myGov — but Gotax makes sure you get it right the first time.

Do I need receipts for everything?

Yes. No receipt, no deduction. Gotax’s Deduction Grabber helps keep you organised.

Can I claim my mobile phone bill?

Yes, but only the work-related portion.

Are self-education expenses tax deductible?

Yes, if the study relates to your current job. No, if it’s for a new career.

Are medical expenses deductible?

Only for disability aids, attendant care, or aged care.

How do I report capital gains?

Include your gain or loss in your return. Keep all purchase and sale records.

What about rental property deductions?

You can claim interest, rates, insurance, repairs — but no travel to inspect properties.

Can I claim super contributions?

Yes, if you lodge a notice of intent with your fund.

Do I need to lodge if I worked overseas?

Depends on your residency status. Gotax can help figure that out.

Do I declare my spouse’s income?

Not for tax, but you must report it for offsets and benefits.

What’s the penalty for lodging late?

Up to $313 for each 28-day period overdue.

Can I set up a payment plan for tax debt?

Yes. The ATO allows instalments — but avoid it by maximising your refund with Gotax.

How does Gotax make tax easier?

We simplify, automate, and make tax cheap and fast. No boring jargon, no hidden fees.

Why Choose Gotax Over Anyone Else?

Here’s the blunt truth:

-

ATO.gov.au is a maze.

-

Etax is overpriced.

-

Gotax is built for Aussies who want it cheap, fast, and easy.

Our online system is $65 for individuals, $140 for ABN workers, and $99 for rental returns — no hidden surprises.

Final Call – Make 2025 Your Easiest Tax Year Yet

Stop overthinking. Stop risking missed deductions.

With Gotax you’ll:

-

Claim every deduction you deserve.

-

Avoid ATO audit headaches.

-

Get your refund faster.

-

Pay the cheapest price in Australia.

Start your tax return today: https://www.gotax.com.au/guest-user

Leave a Comment