October 13, 2024

What can you claim when you attend a conference?

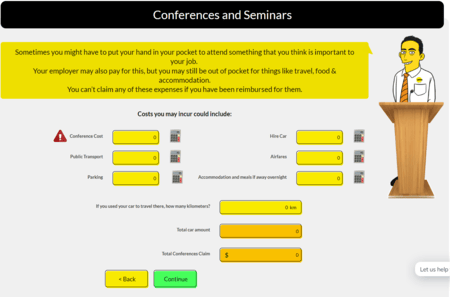

The costs associated with conferences can add up quickly. Many of these expenses may be eligible for a tax deduction if they are directly related to your work (and are NOT reimbursed by your employer). Here's a simple look on how to claim travel expenses for attending a conference, complete with examples and common traps to avoid.

What Travel Expenses Can You Claim?

When it comes to claiming travel expenses for a conference, the key is ensuring that the expenses are directly related to your work activities. Here are some of the expenses you may be able to claim:

-

Airfare and Transport: The cost of flights, trains, or other transport to and from the conference location is deductible, provided the primary purpose of your travel is work-related.

-

Accommodation: If you need to stay overnight, the cost of your hotel or other accommodation is deductible.

-

Meals and Incidentals: You can claim meals and incidental expenses incurred while attending the conference, but only if you are required to stay away from home overnight.

-

Conference Fees: Registration fees for the conference itself are deductible.

Common Traps to Avoid

While many conference-related expenses are deductible, there are pitfalls to watch out for:

-

Mixed Purpose Travel: If your trip is partly for business and partly for leisure, only the business portion is deductible. For instance, if you extend your stay for personal reasons, you cannot claim accommodation and meals for the leisure days.

-

Non-Work-Related Conferences: The conference must have a direct connection to your current work activities. Attending a conference that is only tangentially related to your job may not qualify for a tax deduction.

-

Reimbursed Expenses: If your employer reimburses you for any expenses, you cannot claim those costs as a tax deduction.

Examples

Deductible Scenario: Jane, an accountant, attends a three-day accounting conference in Sydney. She flies from Melbourne, stays in a hotel for three nights, and incurs meal expenses. All these costs are deductible as they are directly related to her work.

Non-Deductible Scenario: Tom, a teacher, attends a general education conference that does not specifically relate to his teaching subject or role. Since the conference does not directly impact his current work activities, the expenses are not deductible.

Gotax Advice

To make the most of your tax deductions, plan your conference trips carefully. Ensure the conference content is directly related to your work and keep thorough records of all expenses. This strategy not only maximises your tax benefits but also helps in case of an audit.

Gotax Deduction Grabber App

To streamline your record-keeping, consider using the Gotax Deduction Grabber App. This handy tool includes logbooks and tax expense recording systems, making it easy to track your deductible expenses throughout the year. Simply scan the QR code to download the app and start managing your tax deductions efficiently.

Conclusion

Conclusion

Understanding how to claim travel expenses for attending a conference can significantly reduce your taxable income and ultimately increase your tax refund. By keeping detailed records and ensuring your expenses are work-related, you can confidently claim your deductions and focus on gaining the most from your conference experience.

Gotax, Online Tax Experts. Maximise your Refund… 2024 Complete Return $55, Simple Return $15. Small Business $120, Rental $99+.

Leave a Comment