July 2, 2025

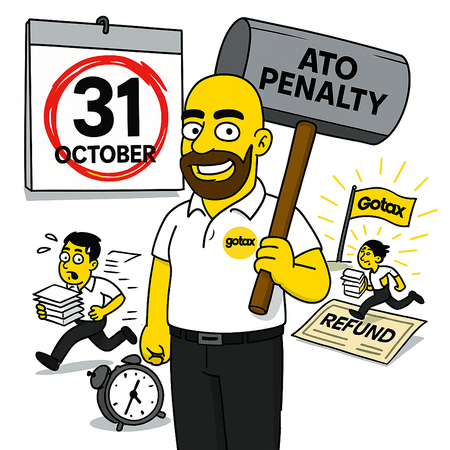

2025 Tax Return Deadline: The Date, the Drama & How to Dodge ATO Pain

The official 2025 tax return deadline is 31 October 2025. If you earned income between 01/07/24 and 30/06/25, you must finalise your tax return. Avoid ATO penalties, boost your tax refund, and find out how GoTax makes it easy — and cheap.

The 2025 Tax Deadline (Write This Down!)

Date: Thursday, 31 October 2025

If you earned any income between 01/07/24 – 30/06/25, you need to finalise a tax return. Doesn’t matter if you worked two weeks or the full year — the ATO wants to hear from you.

And if you don't? Well...

What Happens If You Miss the Tax Deadline?

You’ll enter the magical world of ATO penalties — where every 28 days late costs you $330, up to a grand total of $1,650.

Here’s the breakdown:

| Days Late | ATO Penalty |

|---|---|

| 1 – 28 days | $330 |

| 29 – 56 days | $660 |

| 57 – 84 days | $990 |

| 85 – 112 days | $1,320 |

| 113+ days | $1,650 |

Plus… interest. The ATO slaps on GIC (General Interest Charges) for:

-

Any unpaid tax

-

Late payments

-

Underpaid instalments

Because nothing says “fun” like compound interest from your government.

Didn't Work This Year? Still Gotta Tell the ATO.

Even if you didn’t earn a cent, you’re still expected to say so. That’s called a Non-Lodgement Advice.

With GoTax, we handle that for you. You just click, confirm, and boom — done.

Can I Get an Extension? (Yes, But Don’t Push It)

If you’re signed up with GoTax before 31 October, and you're not on the ATO’s naughty list, we can usually score you an extension to 15 May 2026.

But here’s the fine print:

-

✅ You’ve got no outstanding tax debt

-

✅ You’ve lodged previous years on time

-

✅ No Centrelink or Child Support drama

-

✅ You join GoTax before 31/10/25

Miss those and you’re on your own, champ.

Got Overdue Tax Returns? Resurrect Them with GoTax

The ATO never forgets. Never.

That one return you skipped in 2022? Still there. Looming. Haunting your myGov like a ghost in a spreadsheet.

But don’t freak out — we specialise in fixing overdue messes. We’ll:

-

Help you access missing income info from the ATO

-

Chase down old group certificates

-

Finalise the late return

-

Try to reduce or cancel any fines (if you qualify)

FAQs for the Deadline Procrastinators

“How fast can I finish my tax return?”

In under 10 minutes with GoTax. No appointments. No boring forms. Just follow Derek’s cheeky prompts.

“What if I don’t know my income?”

We can grab your info straight from the ATO — income, Centrelink, bank interest, the works.

“Can GoTax help reduce ATO fines?”

If your history is clean, yes — we’ll argue with the ATO on your behalf. (Politely, but firmly. Derek-style.)

“Do old tax returns disappear after a while?”

Nope. The ATO keeps everything. The Tax Man is basically Santa with spreadsheets — he knows if you’ve been naughty or nice.

Why Use GoTax?

Because we’re the funny, helpful, human way to get your tax return done — not the robotic “you’re on your own” platform.

-

✔ $0 if it’s your first tax return ever

-

✔ $25 if you want it done lightning fast

-

✔ $65 for everything, including deductions, refunds, and expert help

-

✔ Plus, we chase missing info for you

-

✔ And yes, we handle overdue tax returns like pros

Additional resources:

Leave a Comment