If you’ve been working your way around Australia on a Working Holiday visa (subclass 417 or 462), you’re probably due a tidy tax refund. But here’s the catch: you’re taxed under special rules for working holiday makers, not like regular residents. The ATO doesn’t exactly put that on a billboard.

Most working holiday makers pay 15% tax on the first $45,000 you earn—no tax-free threshold, no bells and whistles. If you’re from an approved country with a tax agreement (like the UK, Germany, or Japan), you still get taxed at the same rate, but the tax regime is officially recognised and you won’t get double-taxed on the same income back home.

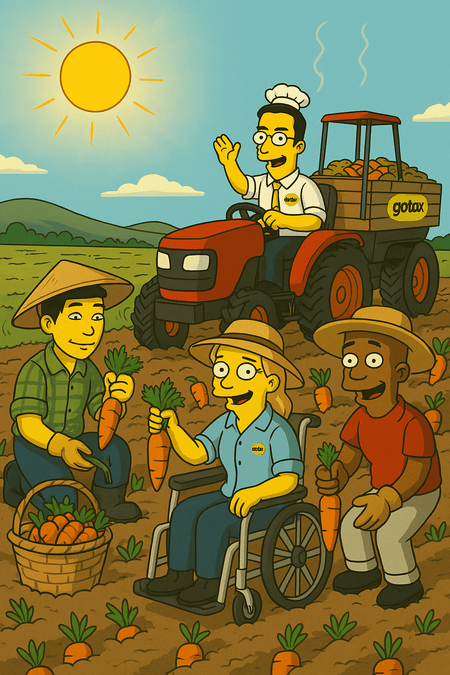

If you lodge your return through the ATO, don’t expect them to dig up every deduction you could claim. That’s where GoTax steps in—we’ll help you lodge your WHM tax return, make it easy, and make sure you get every deduction you’re legally allowed.

Start Your Tax Return Now

Yes, depending on your income and deductions. GoTax ensures your WHM tax return includes everything you’re entitled to.

WHMs are generally taxed at 15% on the first $45,000 earned.

Absolutely. Even without the tax-free threshold, WHMs can claim work-related deductions like tools, clothing, and travel.

Yes. You’ll need a TFN to work legally and lodge your return. GoTax can help if you’re unsure.

Yes. When you leave Australia permanently, you can apply for a Departing Australia Superannuation Payment (DASP).